Deutsche Bank Crisis Lays Bare Europe's Weakness

The doomsday investor mood surrounding Deutsche Bank has laid bare the weakness in Europe’s financial system. Disagreements over how precarious the situation actually is highlights rampant uncertainty.

The situation is unclear – and increasingly hopeless. The denial by Germany, Europe’s largest economy, that it is preparing a rescue plan for Deutsche Bank illustrates how dire investors believe the situation is.

The uncertainty in Europe’s banking sector has never been more tangible than now. The sector’s weak capital situation aside, credit spreads are widening, share prices are highly volatile, and one institute is in focus – Deutsche Bank.

Cacophony of Opinions

Should the German lender run into trouble, a Domino effect would sweep through Europe’s banking system.

The biggest sign of uncertainty is the endless stream of comments and opinions, often contradictory. There is no conventional wisdom on the severity of the crisis, possible effects, or countermeasures.

The cacophony of opinions and supposed knowledge is distorting the banking crisis like carnival funhouse mirrors.

Despite a Denial

Despite denials from Germany’s finance ministry as well as the bank itself, weekly newspaper «Die Zeit» is backing its reporting that Berlin has a state rescue plan for Deutsche Bank. CEO John Cryan has also rejected that the bank needs a cash call.

IMF boss Christine Lagarde sees Deutsche Bank’s health as a a major risk factor for financial stability, but sees «absolutely» no necessity of an intervention.

Feeding Speculation

ECB head Mario Draghi fuelled speculation when he argued that low interest rates couldn’t be the only reason for bank to pose a systemic risk for the Eurozone.

Former British chancellor Norman Lamont identifies a European banking crisis as the continent's biggest worry.

«The biggest threat, I think, to Europe is the banking crisis. I think Italian banks are in a very serious situation; I think German banks are probably in a very serious situation, too,» Lamont said.

«Lehman Moment» – Or Not?

UBS chairman Axel Weber, however, said in a «Bloomberg» interview that the banking system in general far more robust than prior to the financial crisis of 2008-09.

He also said governments are far less likely to intervene on individual institutes. This isn’t Deutsche Bank’s «Lehman moment,» Weber argued, in that the German bank isn’t in danger of failing.

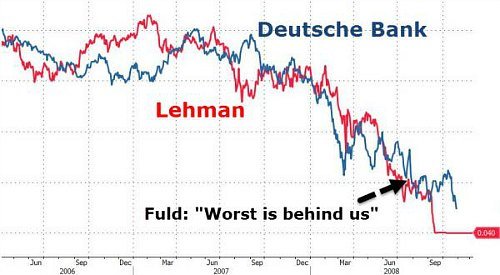

Meanwhile, charts mapping Deutsche against Lehman in 2008 (see below) are feeding a doomsday frenzy.

Tidjane Thiam, CEO of crisis-hit Credit Suisse, didn’t go quite as far as Weber in his views. His comments, also to «Bloomberg», that Eurozone banks are in a very fragile state and «not investable» at the moment don’t exactly induce confidence.

Outflows vs Good Performance

Credit Suisse’s CEO this week experienced just how quickly jitters can spread, leading investors into hasty panic moves.

Thiam alluded to some third-quarter outflows in business with external asset managers – not a decisive business for Credit Suisse. One day later, the CEO talked up expectations for a good performance in the quarter overall.

This fundamental uncertainty and all the potential scenarios for banks and the financial system in the Eurozone are a toxic mix of internal and outside factors.

Toxic Mix

To be clear, banks like Deutsche and Credit Suisse took what are now considered unusually high risks and underpinned them with too little capital, are preoccupied with cleaning up past mistakes, and are grappling with restructuring and strategic overhauls as well as the risk of past scandals.

Add in the political and economic uncertainty and you get the toxic environment that banks today operate in: feeble global growth which has led helpless central bankers to lower rates to near-zero or negative levels, regulatory interventions and political influence, loss of trust and passivity of clients.

Black Box

The business models of global universal banks are already complex and require a high level of management attention as well as risk controls, and the continued headwinds and unforeseeable developments make them into difficult to maneuver supertankers – veritable black boxes.

The social and digital shift piles on the pressure: major banks have enormous costs to shoulder and often radical strategic overhauls of their business models as well as long-neglected industrialization and digitization measures.

Uncontrollable Risks

The banks have to create competitive structures, defend themselves against potential attacks from players outside the sector or fintech-disruptors and identify clients from an increasingly digitally staged future.

Seen from this perspective, banks face insurmountable obstacles. Or at least ones they cannot fully control. The cacophony in markets and among experts is simply a reflection of this.