The Bank of Singapore, the private banking arm of Singapore's second largest banking group OCBC, took a hit in the fourth quarter after their recent purchase of the U.K.'s Barclays Wealth.

Bank of Singapore (BoS) finalised its acquisition of Barclays Wealth last year, paying less that the original sticker price due to a number of bankers and clients not making the transition to the new owners. However the purchase still made a dent in the full year figures for 2016.

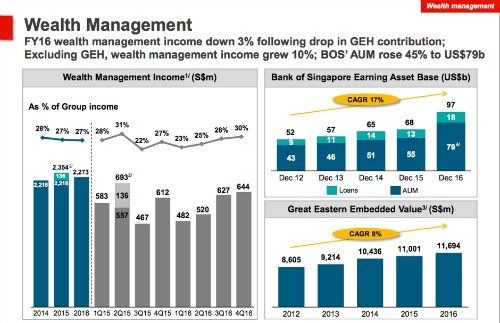

In the full year 2016 results operating profit after allowances rose 6 percent year-on-year to S$1.07 billion from S$1.00 billion in full year 2015, driven by higher net interest income and fee income, partly offset by an increase in expenses.

Lower Price Than Originally Thought

BoS's Assets under Management rose 45 percent to $79 billion (as shown below).

$13 billion in Assets under management (AuM) was transferred to Bank of Singapore, resulting in a purchase price, which was set at 1.75 percent of the AuM transferred upon completion, of $227.5 million. The price was lower than originally thought.

Higher Expenses

Fourth quarter 2016 operating profit of S$257 million was 9 percent lower year-on-year and quarter-on-quarter. The decrease in operating profit in the fourth quarter 2016 was attributable to higher expenses partly from the consolidation of Barclays Wealth and Investment Management (Barclays WIM), which more than offset net interest income growth.

«The Barclays Wealth acquisition further strengthened our wealth management presence, a franchise which continued to perform well,» said CEO Samuel Tsien.