Demand for Gold Slides

Gold suffered a massive slide in demand in the first quarter. Inflows to exchange-traded funds shrank to a fraction of the year-ago period.

Investors bought only 1,034.5 tons of gold last quarter – an 18 percent drop against the year-ago, the World Gold Council said in a statement on Thursday.

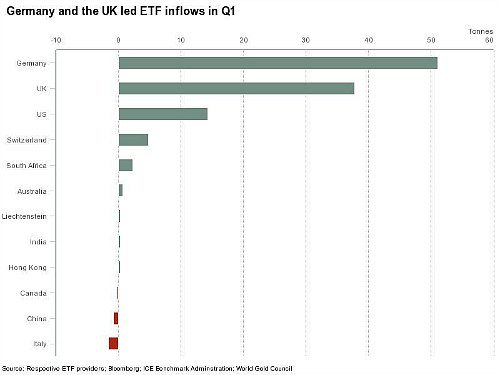

Gold ETFs were hardest-hit by the slide in demand: the 109.1 tons of the precious metal bought are only a fraction of demand in the first quarter of last year. Central banks also bought considerably less gold in the quarter – just 76.3 tons.

Market Weakness?

The World Gold Council stopped short of calling it a slide in demand, saying the difference on the year is especially pronounced due to record-high demand one year ago.

Investment in bars and coins rose 9 percent, while demand for jewelry was stable at a relatively low level of 480.9 tons.