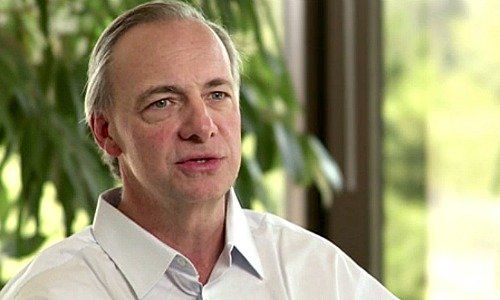

Why Hedge-Fund-Guru Ray Dalio Says Buy Gold

Ray Dalio, head of the world’s biggest hedge fund, Bridgewater, is concerned about recent geo-political developments, and urges investors to protect themselves: by investing in gold.

Founder of the $160 billion Bridgewater hedge fund, Ray Dalio, is worried about the rising tensions between North Korea and the USA.

In a letter to clients, which the «Business Insider» portal has seen, Dalio writes: «US President Donald Trump und North Korean leader Kim Yong Un are playing ‘chicken’ and the whole world is looking helplessly on, wondering who will back down, or whether it will come to a «hellish» war.

«Government Shutdown»

Along with the ongoing Far East crisis, the 68-year-old American is also worried about the domestic policy landscape in his own country. There’s a real threat of a temporary laming of the administration, a so-called «government shutdown», because members of Congress can’t agree on a raising of the upper debt limit.

The consequence of this, according to Dalio, would be a technically bankrupt USA and a significant loss of confidence in the nation’s political system. There have been such «shutdowns» in the past, most recently under the Obama administration.

Caution Called For

The threat of a «government shutdown» and the tensions between the USA and North Korea, pose political risks which Dalio says haven’t been properly priced in. At the same time it is difficult to quantify political risks, unlike economic risks, the multi-billionaire claims.

Precisely for this reason he urges his clients to buy gold to protect themselves against market distortions. The precious metal should constitute 5 to 10 percent of their investment portfolios, he adds.

One result of the war of words between Trump and Kim Yong Un has been an increase in the price of gold, which is currently at almost $1,290. The price of a fine ounce of gold has risen by about 12 percent since the start of the year.