Stalemate on Ermotti Succession?

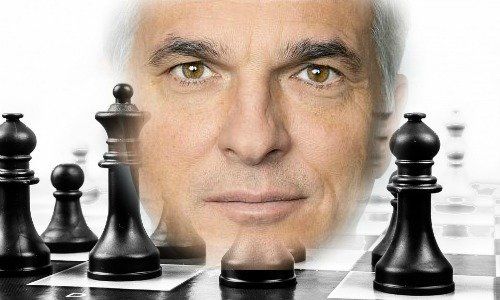

A co-head structure for UBS' heavyweight private bank rings in a new round in the battle to succeed Sergio Ermotti as CEO of UBS. The two most promising candidates may end up in a stalemate.

Exactly one year ago, finews.asia gauged Martin Blessing’s chances to succeed Sergio Ermotti as CEO of UBS as better than most other candidates. On Monday, Blessing’s prospects improved further: the Swiss bank named him the co-head of its newly-created 2.3 trillion Swiss franc combined private banking unit.

It is a dizzying rise for the former Commerzbanker: Blessing (pictured below) took over unexpectedly for UBS Switzerland boss Lukas Gaehwiler just 17 months ago. Last month, he was given the keys to UBS’ private bank when Juerg Zeltner left suddenly. From next month, the German banker will co-run UBS’ new uber-private bank.

If Blessing wants the top job, he could hardly be in a better position to inherit it. Still, his promotion is far from certain – and he has almost certainly been given the high-profile job in order to ascertain how he would perform as CEO.

For their parts, the duo of Ermotti and chairman Axel Weber began openly pondering their future at UBS roughly one year ago. If they were trying to make their succession more predictable, they succeeded. It is more or less accepted conventional wisdom that «Webermotti» will both leave in 2022 – and that Ermotti is flirting with the chairman’s spot.

Singled Out

This brings us back to Blessing, who is viewed as Weber’s man because two know each other from German banking circles. In fact, it was Ermotti who lured Blessing to Switzerland – the two met when Ermotti was with Italian lender Unicredit.

On Monday, Ermotti lavished praise on Blessing’s short tenure as Swiss head: the business had reached its highest business volume since 2003, the CEO said.

He also singled out another banker: Tom Naratil.

The 56-year-old Americas head is just one year younger than Ermotti, and he is a 35-year veteran of the bank. Naratil interned with Paine Webber directly after graduating from Yale. He then worked his way up through the ranks of fixed income, banking and transactions, and strategy.

- Page 1 of 2

- Next >>