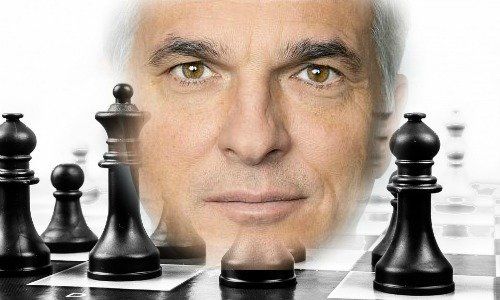

Stalemate on Ermotti Succession?

During the financial crisis, Naratil won plaudits for his handling of a $19 billion auction rate securities probe. The scandal was settled two months before the bank took a Swiss government bailout, and its conclusion fuelled Naratil’s rise in the U. S. wealth ranks. When then-finance chief John Cryan left UBS in 2011 after several crisis-battling years, Naratil was ready to step in.

Swiss Ties

He established himself as a cool and analytical foil to the more tempermental Ermotti, who was named CEO just one year later. Naratil spent four years in Zurich, and in the process cultivated key regulatory contacts. He is viewed very favorably in Bern, for example, and also has fans among UBS’ board.

The implication from Monday’s mega-merger is that Blessing and Naratil are being tested and showcased for the top job. Axel Lehmann, who took over from Blessing in Switzerland this month, and Sabine Keller-Busse, who added the operating chief role to her human resources job, are also viewed as in the running.

Blessing’s tenure is as short as Naratil’s is long. His main achievement while running the Swiss business is a so-called client experience 2020 strategy, the fruits of which won’t be apparent for another two years.

Unsuccessful Co-Heads

How will the new uber-private bank work in practice? Clients and advisors shouldn’t notice much, but UBS of course hopes to reap synergies and savings from tying up behind-the-scenes work.

Blessing and Naratil also have to deliver in an environment which is unpredictable to hostile for wealth managers. The unit is meant to take in net new money at a rate of 4 percent against its existing assets – to do so, the two will inevitably have to work together.

Industry comparisons don’t lend much optimism: Deutsche Bank’s Anshu Jain and Juergen Fitschen, or Oswald Gruebel and John Mack as co-heads of Credit Suisse are memorable examples of how not to do it.

Too Old?

Blessing and Naratil have yet another reason to fear they may be passed over: at 54 and 56 years, respectively, they may simply be too old by the time Ermotti is prepared to give up the top spot. If UBS’ board is doing its maths – and serious about injecting fresh blood – neither of the two may reach the summit.

The race remains open, probably until 2022, leaving enough time for an executive from a younger generation to emerge. Reason enough for Blessing, who rents a flat in Zurich’s prestigious Zurichberg area, to settle into Switzerland for the long haul.

- << Back

- Page 2 of 2