UOB Launches Digital Bank for ASEAN Starting From Thailand

United Overseas Bank is launching its mobile-only bank in Thailand next week. It hopes to attract millennials across ASEAN and serve them over the next decade.

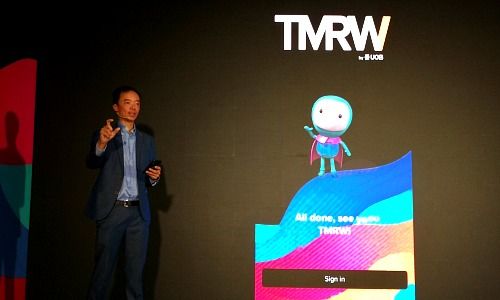

United Overseas Bank (UOB) has launched «TMRW», its mobile-only bank which aims to build banking relationships with Southeast Asia's millennials today, as they are become important clients over the next decade. Thailand's youths will be the first consumers to experience the digital bank next Monday, the bank said during a media briefing on Thursday.

«While ASEAN is known for its diversity, there remains a set of fundamental expectations by the digital generation when it comes to digital services, such as simplicity and an engaging user experience,» said Dennis Khoo, head of group retail digital, UOB, at the briefing.

«So we took the time needed to understand our millennial customers and how and why they engage with mobile apps and digital services the way they do. We then used those insights in designing TMRW for today's millennials.»

Findings From Its Survey

To understand its target customers, UOB surveyed 3000 respondents in Indonesia, Malaysia and Thailand to understand their needs and expectations of financial services back in September 2017.

What they found is this: although millennial consumers appreciate relevant guidance on tracking and managing their finances, they respond better to prompts that are fun. Hence, the bank has designed a money management game help their customers meet their savings goals. In the game, the more they save, the more they are able to build parts of a «virtual city» within the app.

Since the digital generation prefers texting to calling, UOB created a virtual chat assistant within the app. Although it looks like the usual messaging app, the bank has added an automatic call function when the assistant gets non-standard questions.

Measuring Engagement First

When asked about profitability targets, Khoo declined to give numbers and said they are watching the cost to acquire new customers, the costs to service, and costs to innovate. Near-term, they prefer to focus on engagement metrics, which helps the bank to improve features and further draw in new customers.

«It is a simple 2 by 2 metrics. On the vertical axis it's the transactions... on the horizontal axis we show reactions to insights or features, after asking them: did you find it useful? All that is learning for us,» explains Khoo.

Initial Targets

Although gaining customers for TMRW is important in the medium term, Khoo said it is not the near-term priority. Gaining satisfied and engaged customers are.

«It is less important to us than engagement. If we have good customers, say 1 million, we will have advocates and fans. We are not going to repeat the mistake of getting a huge number of clients (quickly),» said Khoo.

Over the next five years, TMRW hopes to gain 3 to 5 million customers, without giving a specific target for Thailand. Although designed with the millennials in mind, UOB does not have an age limit on who uses its new service, as it contributes to the bank's overall strategy to scale up its customer franchise across Southeast Asia.