India has been a major beneficiary of rapid financial technology growth with the sector having contributed to eight percent of gross national income per capita since 2013.

The «average multiplicative contribution» of the sector was about 40 PPP-adjusted (purchasing power parity) dollars which equates to the eight percent figure when accounting for the World Bank’s estimated 500 PPP-adjusted dollars, according to recent research by alternative lender Robocash.

This was due in no small part to strong support from the Indian central bank and its government whose efforts have boosted the fintech market size at a triple-digit pace in the same period. Between 2015 and 2018, the country had the second-highest number of startups founded, with four segments headlining the growth: payments, alternative lending, insurtech and wealth tech.

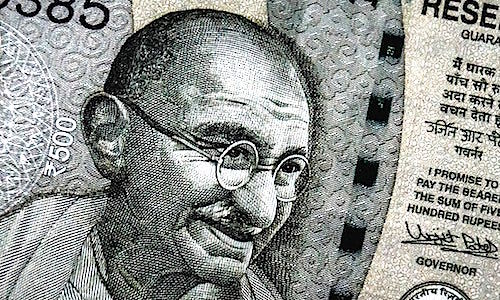

Demonetisation and Internet Penetration

Indian demonetization in 2016, in particular, played a significant role in driving fintech success as a sharp increase in cashless payments and shady economy’s decline led informal and previously unrecorded cash flows to enter the formal banking system.

«[Annual contribution of financial technologies to the national income would only grow,» the report added. «An increase in the use of digital services by the population and further penetration of the Internet in rural areas will play their part in this process.»