Moonfare: Credit Suisse Fallout is Creating Opportunities

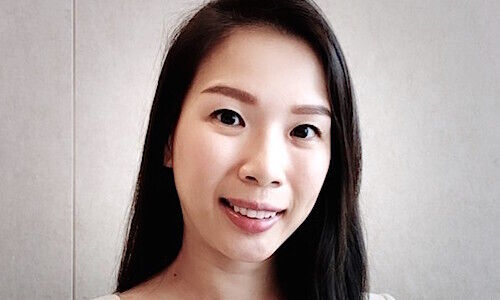

Private equity platform Moonfare is rapidly growing its client base in Asia and the Credit Suisse fallout has been creating even more new opportunities, according to the firm’s regional head of partnerships Kit Toh.

Moonfare has been capitalizing on private equity demand in Asia, including from the growing market of family offices. Its invite-only Moonfare Private Investment Office (MPIO) platform was launched in 2022 and is expected to onboard over 80 family offices worldwide, including around three per month in Singapore.

And as of late, recent news on global banking troubles from the likes of Credit Suisse and its emergency takeover by UBS could be encouraging single-family offices to take their money elsewhere.

«And where can they deploy? We feel like we are on the receiving end of that,» said Moonfare's head of partnerships APAC Kit Toh during a media roundtable attended by finews.asia.

Asia AUM

Within Asia, Moonfare’s assets under management (AUM) reached $233 million last week, accounting for around one-tenth of the firm’s global AUM of over 2.4 billion euros ($2.6 billion).

«A lot of that growth in our AUM has actually come from Singapore,» Toh noted.

Moonfare started its operations in Singapore in April 2022 and the city-state now records around 100 to 120 direct customers per month.

5-10 Percent

According to Toh, private investors should allocate 5-10 percent to private equity. The asset class is expected to deliver superior returns due to better diversification, lower correlation, and more attractive risk-adjusted returns, though there are also risks such as transparency and valuation issues.

Toh also noted that the funds that invest during or after a recession tend to outperform previous vintages.

«We believe, [private equity] is designed to win,» she said.

Moonfare is a digital platform that delivers bite-sized private equity investments to investors. Based in Berlin, it was established in 2016 and has since expanded into 24 countries.