Given the Greater Bay Area's cross-border nature, the 11-city megalopolis is fit to host central bank digital currency pilots, according to a white paper by Standard Chartered and PwC China.

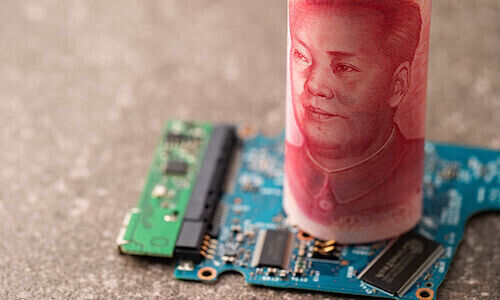

Mainland China and Hong Kong have both been making various efforts to test the use of central bank digital currency (CBDC) with the piloting of the domestic and cross-border electronic yuan as well as plans for the implementation of an electronic Hong Kong dollar.

According to a white paper by Standard Chartered and PwC China, there is further scope for such CBDC pilots, especially with regard to the 11-city cluster of the Greater Bay Area (GBA).

GBA as Launch Pad

The white paper highlights two primary reasons that GBA is an «appropriate launch pad for CBDC pilots» given its «multi-currency, multi-jurisdictional nature».

Firstly, economic activity between the cities continues to grow with 3.8 trillion yuan ($534 billion) of cross-border settlement in 2021, exceeding Hong Kong’s GDP of nearly HK$2.9 trillion ($370 billion). Secondly, the environment could be appropriate for multi-CBDC applications given the ongoing pilots and the facilitation of regulator-industry collaboration.

«The power of CBDCs to create a seamless and innovative digital economy cross-border will be especially important in the context of the GBA. Combining trust and programmability, CBDCs will transform ecosystems and the payments landscape for individuals and businesses across the region and beyond,» said Standard Chartered GBA chief executive Anthony Lin.