Criticism Catches UBS Off Guard

The merged mega-bank has clashed with the domestic industry, a move that could come at a high cost, writes finews.ch Editor-in-chief Dominik Buholzer.

UBS CEO Sergio Ermotti spared no opportunity in the first six months of this year to publicly criticize the government's and regulators' plans for stricter capital requirements. However, the increasingly sour mood among Swiss industrial leaders and their growing dissatisfaction with the new mega-bank were hardly addressed in Ermotti's speeches.

Now, the UBS leadership is facing a more intense backlash. Martin Hirzel, head of the influential industrial association Swissmem, has accused UBS of abusing its power, as reported in the latest edition of the «NZZ am Sonntag».

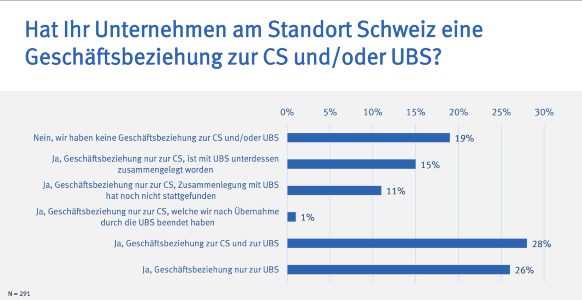

In a survey (see below) conducted by the association, 23 percent of responding companies stated that UBS’s conditions had worsened since the Credit Suisse takeover. This figure has more than doubled compared to the last survey a year ago.

Sabine Keller-Busse’s Efforts Fell Short

It’s not that UBS leadership was unaware of the issue. Sabine Keller-Busse, the head of UBS Switzerland, repeatedly emphasized to journalists how much the bank was doing for the domestic industry. Yet she, too, underestimated the problem, even as recently as last Wednesday at a corporate client event, where she stressed that UBS had no issues with the vast majority of its clients.

The Swissmem survey paints a different picture. However, it’s also worth noting – though this was likely deliberately understated – that 68 percent of respondents reported no issues with UBS and said their conditions had remained unchanged. Additionally, the market environment has shifted, with interest rates and monetary supply being key factors.

(Source: UBS, click to enlarge)

Nevertheless, the criticism has caught UBS off guard, and it comes at a sensitive time. The bank’s workforce reductions are entering a critical phase in Switzerland, branch closures are beginning, and preparations for customer data migration are underway.

It is clear that the Swiss industry feels neglected by the new mega-bank.

UBS leadership would be wise to take this criticism seriously and reassess its lobbying efforts. While stricter capital requirements may indeed limit a bank’s international competitiveness, lacking the support of the domestic industry makes it even more challenging to navigate the political landscape. After all, business leaders are typically well-connected in politics.