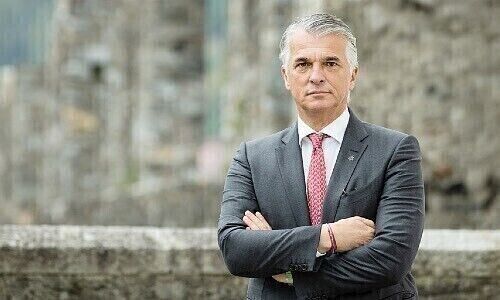

Sergio Ermotti: «There is Still a Long Way to Go»

UBS's unexpectedly strong quarterly profit was primarily driven by its wealth and investment banking divisions, with favorable conditions also benefiting other areas. While management has fast-tracked the integration of Credit Suisse, a considerable journey remains ahead.

«Our businesses delivered impressive revenue growth in the third quarter, and we achieved a strong performance,» said UBS CEO Sergio Ermotti at an analyst call on Wednesday. The figures demonstrate the strength of the business model.

The bank's CEO also expressed his satisfaction with the progress made in restructuring and integrating Credit Suisse. Here, the bank is ahead of the original plan. At the same time, however, he warned against overly high expectations. «We are only about halfway to achieving our goal of being as profitable as we were before the merger.»

An important factor in the cost reductions is the migration of accounts and data from CS wealth management clients to the UBS platforms. Significant progress has been made since June. UBS now projects cost savings totaling $7.5 billion by year-end, up from its previous estimate of $7 billion.

NCL is right on schedule

The wind-up of the transactions combined in the «Non-core and Legacy» (NCL) segment is also ahead of plan. Compared to June 2023, around 52 percent of the positions were closed and the risk-weighted assets (RWA) booked fell from $86 billion to $45 billion. During this period, the RWA share of the Group fell from 15 percent to just 9 percent. The percentage is expected to fall to around 5 percent by the end of 2026.

The people at NCL have done a good job, praised CFO Todd Tuckner. «As it stands now, we would achieve the targets even if we simply waited until the end of the terms.»

Good business performance

In asset management and investment banking, the high income from fees and transactions made a decisive contribution to the overall success. «Although the market environment was positive, it was also characterized by phases of increased volatility and turmoil.» This led to greater client activity and demand for services. Thanks to our proximity to our customers, we are able to provide them with close support even in volatile times. Clients remained very active, particularly in the Americas and APAC regions,” emphasized Ermotti. Furthermore, the pipeline in the M&A business is also growing.

Ermotti believes that the bank is well-capitalized and that the balance sheet can withstand «all weathers». This has also provided the necessary leeway to complete the remaining temporary capital adjustments Purchase Price Allocation (PPA) on a voluntary and accelerated basis. This had a negative impact of $3.4 billion on core capital (CET1), causing the CET1 ratio to fall by 0.65 percentage points to 14.3 percent.

The implementation of the final Basel III standards in January 2025 is likely to reduce the ratio by 30 basis points.

Dependent on decisions in Bern

Ermotti is confident that UBS will be able to launch another share buyback program in 2025, as it did this year. «When we started the buyback program, it was not intended as a stop-and-go measure.» The bank intends to provide further details on this with the figures for the fourth quarter in February 2025.

However, uncertainty remains around the dividend, as this will be influenced by the requirements stemming from the ongoing review of Swiss capital regulations. UBS, therefore, intends to wait for the decisions from Bern. Ermotti does not anticipate any clarity on this before February.

Share price marks high

Analysts reacted positively to the better-than-expected figures and further progress in the CS integration in early trading, with UBS shares reaching a new multi-year high of 29.06 francs ($33.54). Currently, the stock is up only slightly, trading at 28.54 Swiss francs, up 0.3 percent.