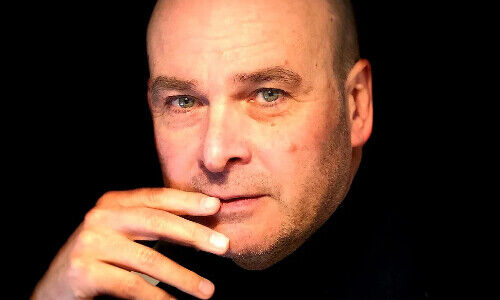

Thomas Signer: «Why Imminent Disruption is Welcome»

Thomas Signer argues that we’re at the cusp of a profound disruption, driven by unprecedented demographic aging and the decoupling of money from the gold standard, both of which have fueled unprecedented levels of debt and asset accumulation. Signs are emerging that these trends may be reaching their peak, potentially culminating in major disruptions, he writes in his piece for finews.first.

finews.first is a forum for authors to comment on economic and financial topics.

Typically, when we think of «disruption», we imagine technological breakthroughs or natural events. Yet, disruption also arises naturally when feedback mechanisms are suppressed – when the forces of the market are interfered with. Suppressing these mechanisms builds tension, and the global capital markets have long been under such strain.

A minor trigger could destabilize this fragile environment, especially in developed countries, due to the interaction between two historical novelties.

«The second major shift occurred in the early 1970s»

The first of these novelties is the unprecedented aging of societies, which accelerated globally from the 1970s, with some exceptions in parts of Africa, Asia, and the Middle East. In many countries, the average age is now over forty, with Japan already nearing fifty.

The second major shift occurred in the early 1970s with the end of the Bretton Woods system. As societies began aging rapidly, the final indirect link between money and gold was severed, ushering in the era of fiat currency. This reintroduction of fiat money – a currency without intrinsic value anchored in physical goods – represents a remarkable shift in human history.

Historically, fiat money lost value quickly and was abandoned. But since the 1980s, thanks to declining inflation and interest rates, fiat money has held its value remarkably well. Much of this «miracle» can be attributed to rapid demographic aging, which has exerted a long-term disinflationary effect. Fiat money enabled massive money creation, leading to soaring debt and asset levels.

«The current state of the gold price alone suggests otherwise»

Since the 1987 crash, financial crises have occurred regularly, with each one poised to reduce debt and asset levels significantly. If left unchecked, these crises might have curbed risk appetite and leverage in the financial world. However, since the 1980s, governments and central banks have actively intervened to counter crises, utilizing the flexibility provided by fiat money to inject new capital, often «successfully».

Now, however, a vast disconnect exists between assets and income: asset prices, particularly stocks and real estate, have reached all-time highs, while GDP and incomes have stagnated. Soaring real estate prices have even accelerated demographic aging, as young people delay family plans due to unaffordable housing.

The growing wealth gap mirrors eras of feudal lords or robber barons, and it's unlikely that income will catch up with assets; rather, a «catch-down» of assets to income levels seems probable, potentially leading to significant disruption. It's doubtful that another financial crisis could be addressed with the same tried-and-true method of injecting newly minted money. The current state of the gold price alone suggests otherwise.

«What unfolds in Japan may eventually be mirrored elsewhere»

Japan appears to have reached a «point of no return». As one of the earliest aging societies, Japan serves as a case study for other nations facing similar paths. With increased volatility in its currency and stock markets, Japan is at a tipping point that hints at a potential paradigm shift. What unfolds in Japan may eventually be mirrored elsewhere, albeit with some delay.

The simultaneous aging of societies and the persistence of fiat money is historically unique. It would be naïve to expect that society as a whole is prepared to meet the challenges arising from changes in the interaction between aging and fiat money. A collective failure may be inevitable, but it is also understandable.

Nonetheless, there is hope for individuals and businesses. Resilience can be developed, and preparations can be made. At a personal level, it may be wise to shift focus from financial wealth to other forms of «wealth» – such as health and human capital, which support long-term employability.

Thomas Signer earned his MBA from Carnegie Mellon University in 1990. His career has taken him across Zurich, London, and New York with both Japanese and American investment banks. For the past two decades, he has worked independently as a financial consultant and teaches finance courses in the MBA program at SBS Swiss Business School in Zurich. His research focuses on the impact of demographic shifts on financial markets. Signer’s two books highlight the delayed parallels between the economic and financial market developments in Japan and the U.S., underscoring the central role of demographics.

Previous contributions: Rudi Bogni, Peter Kurer, Rolf Banz, Dieter Ruloff, Werner Vogt, Walter Wittmann, Alfred Mettler, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Albert Steck, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Frederic Papp, James Syme, Dennis Larsen, Bernd Kramer, Armin Jans, Nicolas Roth, Hans Ulrich Jost, Patrick Hunger, Fabrizio Quirighetti, Claire Shaw, Peter Fanconi, Alex Wolf, Dan Steinbock, Patrick Scheurle, Sandro Occhilupo, Will Ballard, Nicholas Yeo, Claude-Alain Margelisch, Jean-François Hirschel, Jens Pongratz, Samuel Gerber, Philipp Weckherlin, Anne Richards, Antoni Trenchev, Benoit Barbereau, Pascal R. Bersier, Shaul Lifshitz, Klaus Breiner, Ana Botín, Martin Gilbert, Jesper Koll, Ingo Rauser, Carlo Capaul, Markus Winkler, Thomas Steinemann, Christina Boeck, Guillaume Compeyron, Miro Zivkovic, Alexander F. Wagner, Eric Heymann, Christoph Sax, Felix Brem, Jochen Moebert, Jacques-Aurélien Marcireau, Ursula Finsterwald, Michel Longhini, Stefan Blum, Zsolt Kohalmi, Nicolas Ramelet, Søren Bjønness, Gilles Prince, Salman Ahmed, Peter van der Welle, Ken Orchard, Christian Gast, Jeffrey Bohn, Juergen Braunstein, Jeff Voegeli, Fiona Frick, Stefan Schneider, Matthias Hunn, Andreas Vetsch, Fabiana Fedeli, Kim Fournais, Carole Millet, Swetha Ramachandran, Thomas Stucki, Neil Shearing, Tom Naratil, Oliver Berger, Robert Sharps, Tobias Mueller, Florian Wicki, Jean Keller, Niels Lan Doky, Johnny El Hachem, Judith Basad, Katharina Bart, Thorsten Polleit, Peter Schmid, Karam Hinduja, Zsolt Kohalmi, Raphaël Surber, Santosh Brivio, Mark Urquhart, Olivier Kessler, Bruno Capone, Peter Hody, Michael Bornhaeusser, Agnieszka Walorska, Thomas Mueller, Ebrahim Attarzadeh, Marcel Hostettler, Hui Zhang, Michael Bornhaeusser, Reto Jauch, Angela Agostini, Guy de Blonay, Tatjana Greil Castro, Jean-Baptiste Berthon, Marc Saint John Webb, Dietrich Goenemeyer, Mobeen Tahir, Didier Saint-Georges, Serge Tabachnik, Vega Ibanez, David Folkerts-Landau, Andreas Ita, Michael Welti, Fabrizio Pagani, Roman Balzan, Todd Saligman, Stuart Dunbar, Carina Schaurte, Birte Orth-Freese, Gun Woo, Lamara von Albertini, Ramon Vogt, Andrea Hoffmann, Niccolò Garzelli, Darren Williams, Benjamin Böhner, Mike Judith, Jared Cook, Henk Grootveld, Roman Gaus, Nicolas Faller, Anna Stünzi, Thomas Höhne-Sparborth, Fabrizio Pagani, Guy de Blonay, Jan Boudewijns, Sean Hagerty, Alina Donets, Sébastien Galy, Roman von Ah, Fernando Fernández, Georg von Wyss, Stefan Bannwart, Andreas Britt, Frédéric Leroux, Nick Platjouw, Rolando Grandi, Philipp Kaupke, Gérard Piasko, Brad Slingerlend, Dieter Wermuth, Grégoire Bordier, Thomas Signer, Gianluca Gerosa, Christine Houston, Manuel Romera Robles, Fabian Käslin, Claudia Kraaz, Marco Huwiler, Lukas Zihlmann, Sherif Mamdouh, Harald Preissler, Taimur Hyat, Philipp Cottier, Andreas Herrmann, Camille Vial, Marcus Hüttinger, Serge Beck, Alannah Beer, Stéphane Monier, Ashley Simmons, Lars Jaeger, Shanna Strauss-Frank, Bertrand Binggeli, Marionna Wegenstein, George Muzinich, Jian Shi Cortesi, Razan Nasser, Nicolas Forest, Joerg Ruetschi, Reto Jauch, Bernardo Brunschwiler, Charles-Henry Monchau, Ha Duong, Teodoro Cocca, Jan Brzezek, Nicolas Mousset, Beat Weiss, Pascal Mischler, Andrew Isbester, Konrad Hummler, Jan Beckers, Martin Velten, Katharine Neiss, Claude Baumann, Daniel Roarty, Kubilay Yalcin, Robert Almeida, Karin M. Klossek, Marc Taverner, Charlie T. Munger, Daniel Kobler, Patrick Stauber, Anna Rosenber, Judith Wallenstein, Adriano Lucatelli, Daniel Goleman, Val Olson, Brice Prunas, Francesco Magistra, Frances Weir, Luis Maldonado, Francesco Magistra, Nadège Lesueur-Pène, Massimo Pedrazzini, Eric Sarasin, David Ellis, Dina Ting, Christopher Gannatti, Shaniel Ramjee, Mihkel Vitsur, Nannette Hechler-Fayd’herbe, Ralph Ebert, Chris Cottorone, Francesco Mandalà, Mariolina Esposito, Maryann Umoren Selfe, Dominique Gerster, Marc Arand, Christian Kälin, Nadège Dufossé, Benjamin Melman, Brigitte Kaps, Florin Baeriswyl, Marc Reinhardt, Thomas Holderegger, Beat Wittmann, Bruno Cavalier, Louise Curran, Adrian Cox, Philip Adler, Serge Fehr, Marc Lussy, Axel Brosey, Colin Vidal, Vivien Jain, Ralf Zellweger, Maria Vassalou, Nico Fiore, and Gary Burnison.