1MDB: The Abu Dhabi Connection

Investigators are probing what they believe is a billion-dollar graft scandal at Malaysian state fund 1MDB. What is the role of Abu Dhabi’s sovereign wealth executives?

As investigators in at least five countries probe an alleged billion-dollar corruption scheme, Abu Dhabi has been largely silent about its association with the Malaysian state fund.

Khadem al-Qubais–, who previously ran IPIC, one of Abu Dhabi’s largest sovereign wealth funds, until last year was responsible for billions in investments for the ruling family of Abu Dhabi – including stakes in Barclays, Daimler and Glencore.

He is also believed to have run a lucrative embezzlement and money-laundering racket which brought millions to his personal account, «The Wall Street Journal» reported. Former BSI private bankers have admitted running similarly lucrative side gigs in Singapore.

Personal Greed

The official link between Abu Dhabi and 1MDB was for a $1 billion investment into Malaysian real estate, hospitality and energy via a bond guarantee in 2009. Funds put up by 1MDB as collateral against the guarantee never reached Abu Dhabi, landing instead in what is believed to be an British Virgin Island vehicle set up by Al-Qubaisi and Mohamed Badaway Al Husseiny, the former head of an IPIC subsidiary, Aabar.

U.S. investigators believe that billions in 1MDB cash made its way to Malaysian Prime Minister Najib Razak, his stepson Riza Aziz and Jho Low in this fashion.

Al-Qubaisi appears to have stumbled over personal greed, enriching himself with million-dollar kickbacks on deals done for the emirate in an ostentatious fashion grossly at odds with the emirate’s Islamic traditions.

Clubbing in St.-Tropez

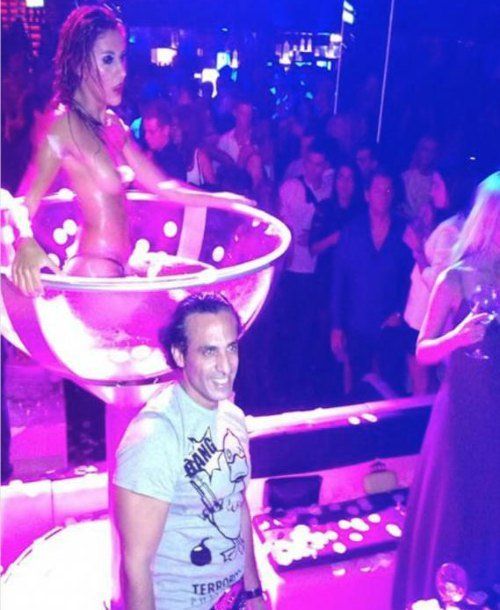

For example, Al-Qubaisi was snapped at a St.-Tropez nightclub frolicking with a topless woman, in unattributed pictures published by blog «Sarawak Report» (see below).

He appears to have spent his ill-gotten gains on a stake in a Formula 1 racing team, $31 million kept in luxury cars stored in Switzerland including a Bugatti Veyron, homes in France, private jets, and cash maintained in a Luxembourg account.

Another business contact said he met Al-Qubaisi at a villa in the south of France where the IPIC head conducted business in his swimsuit while women in scant clothing milled around. On official business in Las Vegas, where Abu Dhabi owns the Omnia nightclub, British singer Rita Ora sang «Happy Birthday» to Al-Qubaisi three years ago at Hakkasan, another emirate-owned club.

His attempts to enrich himself grew ever more audacious, the newspaper reported: A consulting firm claimed that Al-Qubaisi asked outright for a $300 million kickback in relation to IPIC’s attempted takeover of the Four Seasons Group, a hotel operator. Neither the acquisition nor the kickback appears to have materialized.

Bring to Justice

Al-Qubaisi, who along with Al Husseiny is imprisoned in Abu Dhabi, had already been pegged by Swiss investigators. However, the emirate has until now been reserved about the matter, aside from removing Al-Qubaisi from his post last spring, a move for which no explanation was given.

Instead, clues have come from outside Abu Dhabi, such as from the U.S. investigation. Switzerland, where IPIC owns Zurich-based Falcon Private Bank, has also been instructive.

Al-Qubaisi and Al Husseiny are likely to be the two people that investigators were referring to when they shut down Falcon’s Singapore branch and sanctioned its Swiss head office in October. The two «pursued their own illegitimate purposes,» Finma, the Swiss regulator, said at the time.

Al-Qubaisi’s and Al Husseini’s alleged wrong-doing is hard to pin down because Abu Dhabi isn’t officially cooperating with the global 1MDB investigation. The emirate merged IPIC into another, larger sovereign wealth fund this summer, but not before taking a $3.5 billion provision for the 1MDB bond guarantees. Neither man has been charged.

«We are committed to bringing him to justice,» a member of the UAE’s ruling family told «The Wall Street Journal,» without elaborating.