The career of recently deceased former Deutsche Bank head Anshu Jain is exemplary of the rise and fall of European investment banks. Credit Suisse leadership should take note.

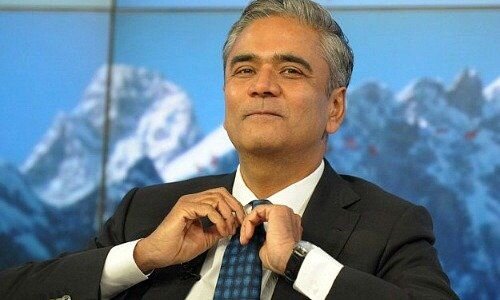

Only a select number of people have dominated the European investment banking landscape as much as Anshu Jain, who died at the age of 59 of cancer on the weekend.

Since the turn of the millennium, his work is exemplary of the attempts by European banks to scale the top league of the investment banking industry and compete against Wall Street's dominance.

But it also showed the damage that certain, misguided decisions could reap, and they are lessons that Credit Suisse would do well to pay close heed to given its current difficulties.

Private Jet Crash

(Image: Keystone)

Anshu Jain, who originally hails from India left Delhi at 20 to study in the US, subsequently becoming one of the youngest managing directors at Merrill Lynch, the former industry-leading brokerage. In 1995, he switched over to Deutsche Bank with his then mentor Edson Mitchell, where both of them massively expanded the investment bank under CEO Josef «Joe» Ackermann.

After Mitchell's death in a private jet accident in 2000, Jain was the only one in the driver's seat and he became the leading light of the investment banking business, which made up to two-thirds of Deutsche Bank's entire profit in good years.

Axel Weber Rebuttal

But Jain's work progressively started to go in the wrong direction. After other leading European institutions throttled back their investment banking businesses following the 2008-2009 financial crisis, with UBS under CEO Sergio Ermotti being a clear exponent of that, Jain kept expanding. But the times were very different and the bank's other divisions could no longer compensate for dwindling investment banking revenues, exploding costs, and increased regulatory burdens.

After Deutsche Bank failed to appoint former Bundesbank president Axel Weber as a successor for Ackermann, Jain was appointed co-CEO together Juergen Fitschen. Besides managing the domestic business, Fitschen, a German citizen, was also supposed to keep Jain in check. He failed and Deutsche Bank slithered into a deep crisis in 2015, which led to the duo leaving the bank entirely shortly afterward.

Problems and Scandals

(Image: Keystone)

There is a certain irony in the fact that Axel Weber became UBS chairman instead. Both he and Ermotti became the architects of UBS which remains extremely stable to this very day, with its shackled, straitjacketed markets and advisory businesses. That is entirely in contrast with Credit Suisse, which still faces a large-scale restructuring and questions about what the future shape of its investment banking franchise should be.

This much is true. Investment banking is not a bad business per se. But it requires an enormous amount of resources and expertise. The European competitors were trying to reach for the stars when they simply did not have the depth and means to compete in the top leagues with the likes of US investment banks such as Goldman Sachs, Morgan Stanley, and JP Morgan.

Bat Out of Hell

Credit Suisse has been trying it long enough with its investment bank, which still has all the hallmarks of the culture of its former Credit Suisse First Boston (CSFB) business. Many of those same investment bankers have been responsible for the cavalcade of problems and scandals that it currently faces and which have led Credit Suisse into its current misery.

Anshu Jain was undoubtedly a world-class investment banker who made it to the top of a global financial institution. But he needed a structural and organizational framework that has never really existed at any European bank. Just acknowledging this would have spared both Deutsche Bank and Credit Suisse many of the problems they subsequently faced. But instead, they continued to compete with Wall Street with the same kind of abandon as a bat out of hell.

The Drivers and the Driven

The conclusion that Jain was both a «driver and driven» as the «Frankfurter Allgemeine Zeitung» aptly maintained (German, behind paywall) forcefully highlights the European investment banking dilemma. On the edges of a party at the World Economic Forum in Davos he once said what he expected of his employees.

«Intelligence, hunger, and devotion,» he replied, very likely the same qualities he himself had when starting out in the US. It might be an idea for Credit Suisse leadership to keep that in mind when setting a new strategy for the bank.