What Qualifies Julius Baer's New CEO

In retrospect, it is surprising how long it took Julius Baer to find the right candidate. Apparently, some candidates did not trust their own ability to sustainably raise the share price. Will this change with the new CEO?

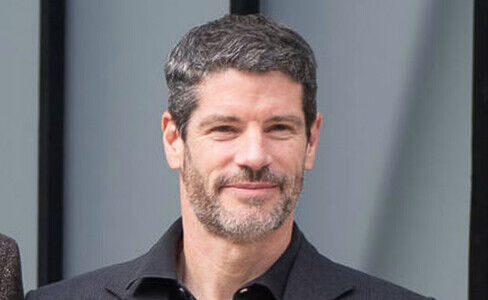

All in all, the appointment of the new CEO at the traditional Zurich-based bank has gone fairly smoothly. The result, surprisingly announced on Tuesday, is quite impressive: 50-year-old Stefan Bollinger, a Swiss national with extensive international banking experience, is taking the helm. He has learned the business from the ground up, starting as an apprentice in banking to reaching the heights of high finance at Goldman Sachs.

In this regard, Julius Baer President Romeo Lacher has admittedly achieved a coup, which seemed increasingly unlikely as the search dragged on. Moreover, he has wisely avoided entrusting the bank's operational leadership to one of those unsatisfactory co-leadership models that have become common in banking, even though it is well known that they rarely yield results and are usually a poor compromise.

Responsible for Tomorrow's Investment Story

Bollinger qualifies as the future CEO of Julius Baer not only because of his experiences with such prestigious employers as Goldman Sachs, J.P. Morgan, or the steady Zurich Cantonal Bank (ZKB), and not only because he has worked in diverse areas such as trading, product structuring, sales, treasury, and wealth management, but above all because he brings Anglo-Saxon expertise. Besides Zurich, he has worked in London, New York, Hong Kong and Luxembourg. This is what matters.

He will be the one to «promote» Julius Baer's future investment story to the predominantly Anglo-Saxon and opinion-leading financial analysts worldwide. And who better to do this than a Swiss person who is confidently familiar with the global financial industry?

Dramatic Value Destruction

Julius Baer's headquarters in Zurich (Image: finews.com)

In the end, it is less about the amount of assets under management and more about the potential of the Julius Baer stock listed on the Swiss Stock Exchange. The stock price determines the success or failure of every CEO.

The Julius Baer stock urgently needs a boost. When Boris Collardi announced his resignation as CEO of the bank on November 27, 2017, the stock was trading at 60 Swiss francs ($67). Today it is around 50 francs, representing a clear destruction of value during the era of Bernhard Hodler and later Philipp Rickenbacher.

Unpretentious Statement

In retrospect, it is surprising how long it took Julius Baer to find the right candidate. Apparently, some candidates did not trust their own ability to sustainably raise the share price and instead demanded high fixed salaries. The Julius Baer nomination committee was evidently not impressed by this.

Against this background, Bollinger proves that he believes in this traditional Zurich-based bank, which urgently needs such a leadership figure at its helm from February 2025. This is also underscored by his first, very unpretentious statement on Tuesday following the announcement of his appointment when he said, «I am honored to lead this storied institution.»