Are high salaries dragging private banking into the abyss?

Despite falling revenues, Swiss private banks are failing to bring down their high salary costs. Time is running out for the sector.

Tax disputes, falling margins and escalating banking laws have all been recognized by Swiss private banks as structural threats to their business. Measures have been introduced to deal with these challenges.

However, one threat not being adequately dealt with by the elite Swiss banking sector is the increasingly alarming salary situation. It can’t be said that the problem hasn’t been identified. For months experts have been coming forward to present studies warning of the risks of high salaries in private banking.

As bad as the turn of the millennium

Zurich consultancy firm IFBC, which has made a name for itself in takeover deals, is the latest to tackle the issue. After screening some 40 Swiss banks, IFBC came to the conclusion that the financial institutions were not managing “to adapt their personnel costs to the new reality of revenue levels”.

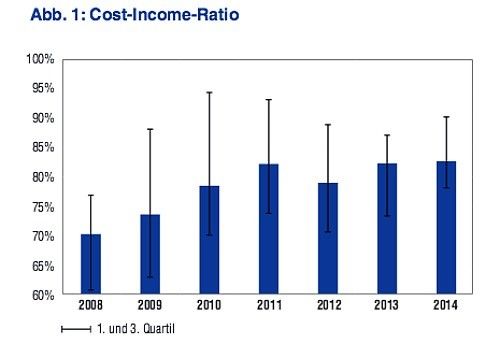

The banks’ inaction has contributed to the outcome that banking central cost-income ratio was 82.9 per cent on average in 2014. That is the highest – and most alarming – level since the turn of the millennium, the consultants point out (see graphic).

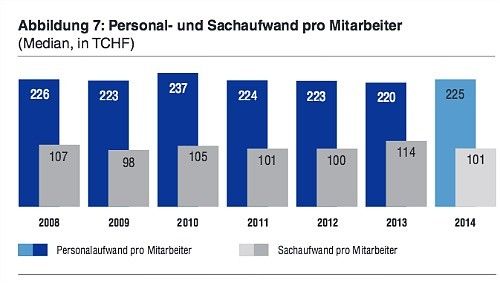

The IFBC study notes that private banks are not reacting quickly enough to this phenomenon. Personnel costs have stagnated over the past six years at around 220,000 francs on average per employee (see graphic below).

In the same time period, commission levels and service success dropped by 15 per cent per employee (see graphic), while the operating profit of the banks surveyed fell by an average of 20 per cent.

Fear of defectors

The study gives no indication that the situation is likely to change in the near future because the banks are caught in a predicament.

Experts from the auditing and consulting firm KPMG examined the issue recently in Switzerland and explained that banks who tried to cut salaries would be faced with drastic consequences.

In private banking, salaries must be seen as fixed costs, they concluded. No bank would dare to reduce the salaries of highly sought-after client advisors because this would drive the employees straight into the arms of the competition. Any defections carry the added risk that the institution could lose more assets, which would narrow the revenue base even further.

Digital way out

Both the KPMG and IFBC studies see a way out of this vicious circle. IFBC recommends exploiting digital channels more to ease cost pressures. But the investment required for this kind of technology is out of the price range of smaller banks.

Instead they may be victims of “further consolidation” in the sector, as predicted by the IFBC experts, due to the sustained pressure on revenue and costs.