HSBC Private Banking Hurt by «Swiss Leaks»

HSBC, the Anglo-Chinese banking giant, was badly affected by the «Swiss Leaks» affaire, putting a damper on the results achieved in private banking in 2015.

HSBC's difficulties have their origins in Geneva, Switzerland's second-largest financial center. A year ago, the «Swiss Leaks» affaire burst onto the scene. Suspected offenses against taxation laws at the Swiss private bank became public knowledge.

The turbulence surrounding the financial scandal and the structurally difficult economic environment left their marks on the books of the bank. Profitability at the Global Private Banking division of HSBC declined by almost 50 percent last year, according to its annual report published yesterday.

Pretax Profit at Private-Banking Unit

The unit had a pretax profit of $344 million last year, compared with $626 million a year earlier. While revenue decreased marginally, costs soared by $1 billion.

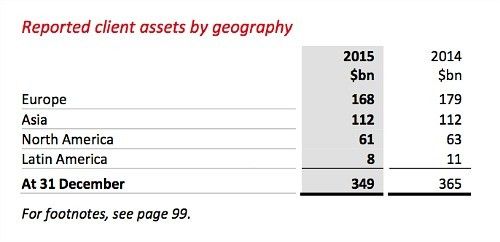

The Swiss private-banking unit is the epicenter of the problem. In Europe, assets under management dropped $11 billion, while the same figure in Asia remained unchanged (see below).

HSBC Geneva hasn't answered a request for a detailed account about the Swiss business yet.

Decline in Assets Under Management

Total assets under management declined $16 billion to $349 billion last year. A result, which will have upset the managers. In Switzerland, HSBC country boss Franco Morra axed 260 jobs, pared the number of markets in which the unit was active and also said it won't serve the not-so-rich clients anymore.

Whether these measures have helped to turn around the fortunes of the bank remains to be seen. The current situation of the market is volatile and the difficulties haven't all been solved yet. HSBC Switzerland is one of the so-called category I banks, against which the U.S. judiciary initiated criminal proceedings. The country is, along with a number of others, investigating the suspected wrongdoings of the company in the «Swiss Leaks» scandal.