Private Banking in M&A Frenzy

The impression that Swiss private banking is suffering from a particularly heavy bout of merger-and-acquisition fever has now been underscored by a study. How long the buying and selling frenzy will continue for is more questionable.

In Switzerland, 2015 was a year of a new-found self confidence which manifested itself in a string of mergers and acquisitions in private banking. That's the conclusion of analysts at the U.K.-based Scorpio Partnership in a recently published study on M&A activities in global private banking.

The Swiss deals stuck out in terms of size, with the average size of assets under management involved at $9.4 billion, the highest score of all countries.

Second Only to the U.S.

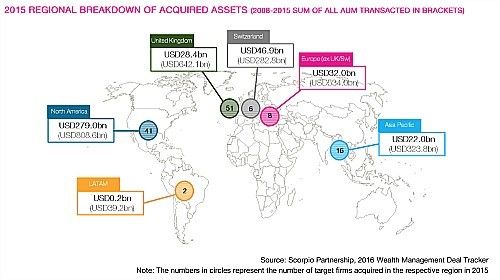

The Swiss mergers and acquisitions also managed a top position in the ranking of total volume. Only the U.S. saw a bigger total of assets under management change hands last year (see illustration below).

The conclusion of Scorpio isn't surprising given the transactions of last year. Union Bancaire Privée bought Coutts International, Notenstein merged with Bank La Roche 1787 and BTG Pactual for a short while took BSI under its wings.

Switzerland is still the largest offshore wealth manager and with it remains exposed to attacks from other jurisdictions.

Frenzy Has Peaked

The dynamic development of Swiss private banking may not necessarily continue at the same pace. The study authors say the total of assets under management bought or sold has peaked last year. The volume declined to $408.5 billion from $461.4 billion a year earlier. The number of transactions increased.

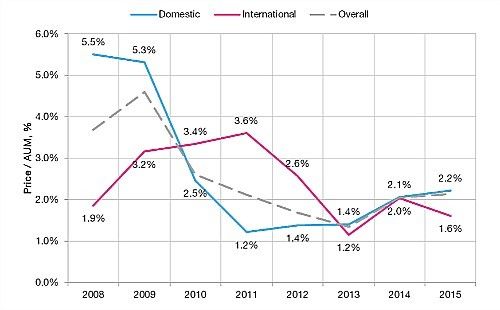

And so did the prices paid. The rose to 2.14 percent from 2.06 percent of acquired assets (see illustration below).

Buyers paid the highest prices for domestic institutes with assets of $5 to $10 billion. Several Swiss banks have said that they are mainly looking to buy smaller domestic players.

In conclusion though, he study seems to suggest that the more exciting times in terms of mergers and acquisitions may already be a thing of the past.