UBS Retains Top Spot in Wealth Management Ranking, But Slips

In a ranking of the world’s largest wealth managers, there were some changes in 2015 but UBS has kept its place at the top. Credit Suisse has lost ground.

The ranking shows that 2015 was rather a difficult year for global wealth management. The flow of new money could not compensate for the lower values of client assets, the study by research company Scorpio Partnership found.

Overall, client assets under management worldwide shrank by 1 per cent, while the net inflows of new money were 6.9 per cent down on the previous year.

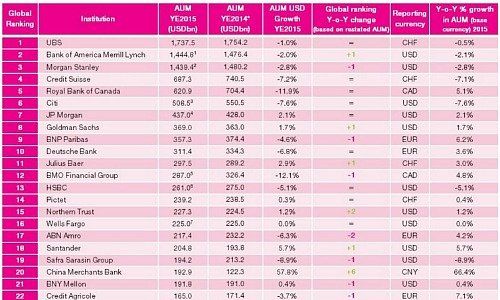

This has led to certain changes among the largest wealth managers – however not at the top where UBS holds on to pole position. Scorpio calculates the assets under management of UBS at $1,738 billion, 1 per cent less than in 2014.

Credit Suisse Lost More

In second place there was a changing of the guard: Bank of America Merrill Lynch overtook Morgan Stanley, whose managed assets fell by 2.8 per cent. Bank of America lies 300 million dollars short of UBS.

Credit Suisse (CS) follows in fourth place, with a drop of 7.2 per cent in client assets to 687.3 billion dollars calculated by Scorpio. The lead of the top three has now widened even more. CS would need some 750 billion dollars in client assets to close the gap.

Four other Swiss private banks number among the world’s 25 largest wealth managers: Julius Baer occupies 11th place; Pictet is unchanged in position 14; J. Safra Sarasin slipped down one place to 19th; Lombard Odier is also down one place to 24th.