UBS’ American wealth management arm, which has long lagged the wider flagship private bank, was a standout performer in the third quarter. Nevertheless, unit head Tom Naratil will still have his hands full.

The Swiss bank’s third-quarter results brought a surprising development to light: the U.S. wealth management arm, led by former finance chief Tom Naratil, hiked its pretax profit by 28 percent to $367 million – a record for the unit.

The solid result was underpinned by record-high interest income and a rise in management fees.

Juerg Zeltner

By comparison, profit at UBS’ powerhouse private bank, run by Juerg Zeltner, sank 8 percent to 643 million Swiss francs.

The American arm did better sequentially too: pretax profit rose more than in the wider money management arm for the wealthy, which encompasses Europe, Asia, Switzerland and emerging markets.

Naratil, who took on the U.S. role in January, seems to be on the right track for the American unit, which has long been the subject of speculation. UBS has repeatedly reinforced its commitment to the unit, which was rehabilitated by former Merrill Lynch executive Bob McCann.

Meager Profits

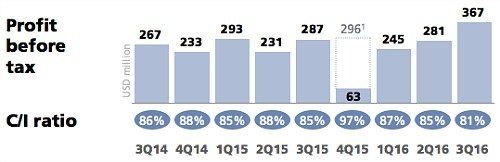

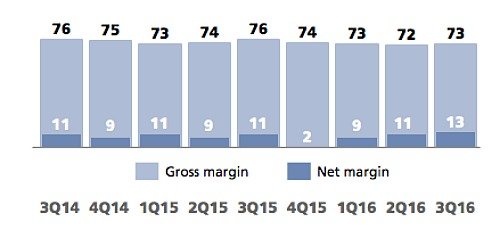

A closer look reveals that the U.S. unit’s profitability is far away from what investors would expect from traditional private banking activities. The unit’s net margin was a meager 13 basis points in the third quarter – 2 basis points more than in 2015 (see graphic below).

Income of almost $2 billion is set against costs of more than $1.6 billion, leading to a cost-income ratio of 81 percent (see graphic).

Naratil managed to improve this result by 4 percent on the year, but it is still well off the 64 percent in Zeltner’s wealth management arm. And at 27 basis points, the flagship private bank’s net margin is nearly double Naratil’s in the U.S.

More Needed

This means Naratil has to cut costs, presumably in part by trimming the bank’s staff. He also has to hike revenue – the unit’s $1.1 billion under management must become more nimble.

Naratil has already revealed part of his plan to revamp the American bank formerly known as Paine Webber.