DBS Still Has Room for ABN Amro

After sealing a surprise deal in snaring the Asian wealth units of ANZ Piyush Gupta said, that he could not comment about any interest in acquiring the Asian private banking business of ABN Amro.

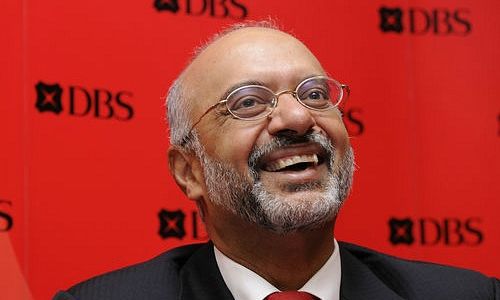

Addressing the media the ebullient CEO was in fine form as he rattled through numerous reasons why the ANZ deal was so easy, «it pays for itself,» he beamed.

And so it does, it was a shrewd deal by DBS, the extensive mass affluent numbers embedded in the ANZ business will provide a fertile pipeline for the private bank and the cost synergies are obvious. It simply bolts on to the existing DBS business offerings in Singapore, Hong Kong, China, Taiwan and Indonesia.

The Usual Suspects

And it was a deal that did not dent their war chest. The usual players are said to be in the hunt for the ABN Amro Asian business, Julius Baer, Bank of Singapore, Union Bancaire Privee, perhaps also Credit Suisse and LGT.

But do not discount DBS coming back in for another European business.

Watch This Space

While on the surface it might look that the ANZ deal will keep the bank occupied, integration should be relatively smooth and they have done it before.

When pushed for a second time on ABN Gupta said that if the deal made sense and he saw operational band-with to accommodate ABN they might consider it. However he stressed that DBS wasn't in the business of wanting to bulk up on assets under management and become big just for the sake of being big. «We would never want to be the highest bidder,» he said.