Daryl Liew: «What is Trump’s Impact on Asia?»

Looking back, 2016 has been a roller coaster year for financial markets, says Daryl Liew from Reyl Bank. But what can we expect for 2017?

Well, the biggest macro event for Asia is what Donald Trump does when he takes over at the Oval office. We have already seen significant market rotations since his victory, with Asian markets selling off. Let us see if these concerns are warranted.

Asia’s first concern is that Trump follows through with his anti-globalisation rhetoric and slaps higher tariffs on exports from countries like China. Asia growth has been driven by international trade and a move inwards to close off US borders will adversely impact regional growth. With the threat of trade wars brewing, one should be cautious on export and trade-related investments.

Significant Loss

The death of the TPP is indicative of the current anti-trade sentiments in the West. These sentiments however are not shared in Asia, where leaders are focusing their efforts on another trade pact – the Regional Comprehensive Economic Partnership (RCEP), which includes the ten South-East Asian countries plus China, India, Japan, Korea, Australia and New Zealand.

While the US is a significant loss, the RCEP nations have a collective population of over 3 billion and a GDP comprising approximately 30% of the world’s total. Stronger intra-regional trade, driven by the growing Asian middle class, hopefully will make up for that which is potentially lost from the US.

US Military Withdrawal?

The next major issue worrying Asia is whether the US maintains a military presence in the region. On the campaign trail, Trump was vocal about having other nations pay their share to fund US overseas bases. A withdrawal of US troops from the region could be destabilising, creating a security vacuum that could lead to rising geo-political risks, especially when you consider the existing tensions in the South China Sea. It is worrisome that many Asia Pacific nations are expanding their defense budgets, increasing the risk of a military conflict.

In fact, a US military withdrawal could be playing right into China’s hands, as China is more than willing to fill the vacuum of “big brother”. China’s recent initiatives – One Belt, One Road and the establishment of the Asian Infrastructure Investment Bank – have resulted in major commitments to various infrastructure projects across Asia. This is part of China’s strategy to increase its political and economic influence in the region. As a case in point, both the Philippines and Malaysian leaders recently visited Beijing and left clutching multimillion investment packages.

Dollar Strength?

The USD has rallied since Trump’s victory and could continue to strengthen if his reflationary policies pan out, putting pressure on the Fed to hike rates faster than expected. Weaker balance sheet currencies like the Malaysian Ringgit and the Indonesian Rupiah, which enjoyed strong gains in the first three quarters of the year, have suffered significant selloffs. The Chinese RMB has also come under pressure, though this is mainly due to USD strength, as the RMB has remained stable against the CFETs diversified basket of currencies.

The good news for Asia is that there could be a limit as to how much further the USD can appreciate, as a strong USD is not really in America’s best interests. A weaker USD is arguably preferred if Trump really wants to create manufacturing jobs for his supporters in the rust-belt states.

India and Vietnam Preferred in 2017

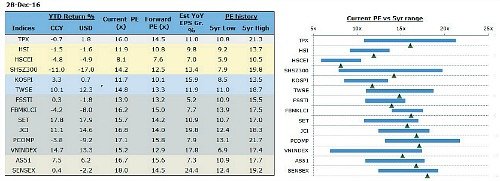

The table and chart below shows the year-to-date performance and current valuations of various Asian markets. Despite the volatile market conditions, South East Asian markets have led the way in 2016 with Thailand, Indonesia and Vietnam the best three performers in the region. Taiwan has been the lone bright spot in North Asia. Looking ahead, North Asia will continue to face headwinds, as a large part of North Asia is plugged into the global manufacturing supply chain and at risk from the anti-globalisation movement.

The less developed South East Asian economies could still outperform in 2017 as they continue to be the recipients of foreign direct investments. Vietnam, despite the death of TPP, still looks attractive, especially as the government moves to privatise state owned enterprises. Sabeco, the dominant brewer in Vietnam, recently listed and there is a strong pipeline of further IPOs.

What Else?

The Philippines stock market suffered a significant de-rating since President Duterte took office, with foreign investors selling. Valuations are now looking a lot more reasonable. Both Vietnam and the Philippines are expected to enjoy 6 percent GDP growth in 2017, amongst the fastest in Asia.

India is also one of our preferred markets for 2017. The Indian stock market was recently impacted by Prime Minister Modi’s unexpected de-monetisation policy to take existing 500 and 1,000 rupee notes out of circulation. This move has led to a cash crunch and will likely impact the economy for the next few quarters as economic activity slows. Corporate earnings will likely take a temporary hit, but the selloff presents a buying opportunity.

One of the advantages of India is that it tends to be largely uncorrelated to the other Asian markets, mainly being dependent on domestic growth rather than exports. There are also signs that Modi’s reforms are starting to get traction – the implementation of GST in April 2017 is significant and will improve business efficiency.

Japan More Upside Potential

The Japanese stock market has been one of the main beneficiaries of Trump’s win, with the JPY weakening significantly. This trend could continue into 2017 with interest rate differentials widening. Also, Japan doesn’t appear to be targeted by Trump on potential protectionist measures. Valuations for Japan are still looking reasonable, with further potential earnings upside as benefits from the weaker JPY start coming through next year.

January 28th marks the start of the Year of the Rooster and hopefully the domesticated animal will be crowing about better days ahead in 2017. At least that could be the case for some parts of Asia.