Reaching Southeast Asia's Wealthy

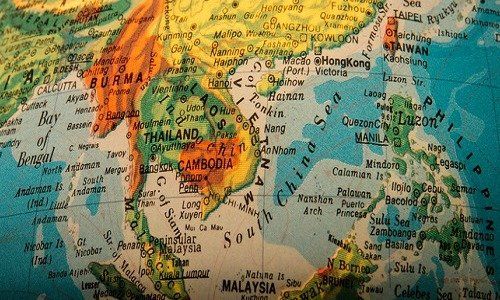

How do foreign fund houses go about tapping into the growing wealth across Southeast Asia without going through the lengthy and uncertain process of setting up a costly and increasingly regulated onshore business?

The global research and consulting firm Cerulli Associates expects more foreign fund houses to set their sights on penetrating Southeast Asian markets to tap the increasing wealth in the region.

However instead of setting up an onshore presence, which can be costly, difficult and does not guarantee success, the ideal strategy developing is via the master-feeder structure.

Saving Time and Costs

This conduit allows foreign players to save time and cost, and also leverage their local partners' brand names and tap their existing distribution networks, Cerulli says in its latest Asian Monthly Product Trends report.

While first movers are more likely to form stronger partnerships with local players in these markets, they may take time to see actual profits.

Key Entry Strategy in Southeast Asia

The increasing demand for foreign-invested funds across key Southeast Asian markets, including Malaysia, Thailand, Indonesia, and the Philippines, has created opportunities for foreign fund houses who are keen on penetrating these markets.

The ideal strategy for such fund houses is to enter through the master-feeder structure.

In Malaysia, many foreign fund houses have looked to the wholesale fund structure to launch feeder funds as approvals for retail unit trust feeders have been hard to obtain in recent years, due to differences in investment restrictions and guidelines between Malaysia and other markets.

Going Local is Best

In Thailand, feeder funds continued to register decent growth during the 11 months to end-November. Fixed-income feeder funds had been the key driver, growing 188 percent to $1.3 billion in November.

Within the feeder fund space, big names such as J.P. Morgan Asset Management, Pimco and Schroders continue to dominate as top choices for master funds even without onshore offices.

Working With Boutiques

The three firms have each amassed assets under management exceeding $1 billion in both Malaysia and Thailand. The amount, which is larger than most of the domestic firms', suggests that feeder funds are still the best way to go for a foreign manager to penetrate these markets.

Another positive development is that local fund houses in both Malaysia and Thailand are gradually opening up to work with boutique, less well-known managers or Asia-based firms. And whether it is a global or boutique offshore fund house, the important element for success within the feeder fund business lies in securing local partners with strong distribution capabilities.