DBS Wealth Management Achieved Broad-based Growth in 2016

Singapore's largest bank DBS followed its local rival OCBC in reporting its full year 2016 results. Like its neighbour the private banking and wealth management units held up in challenging markets.

For DBS the wealth management business which sits under the umbrella of consumer banking continued its consistent upward momentum according the full year 2016 results published on Thursday.

Consumer Banking/Wealth Management income rose 21 percent to S$ 4.28 billion. The growth was broad-based across loans, deposits, bancassurance and cards.

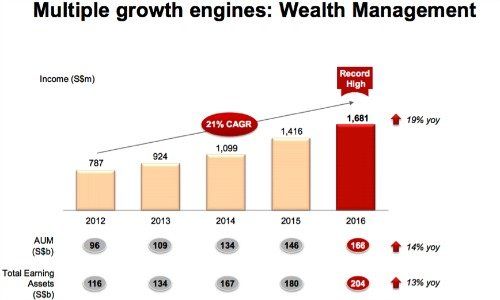

Wealth Management customer segment income increased 19 percent to S$ 1.68 billion with assets under management growing 14 percent during the year to S$ 166 billion.

The Assets under management will likely continue to grow in the first half of 2017 as DBS works to fully integrate the ANZ retail and wealth management units it acquired late last year.