UBS has introduced its new mobile payment solution in Switzerland which has been adopted by more than 30 banks. Will the Swiss wealth management giant be rolling it out in Asia?

Over the last few weeks a high-level Swiss delegation led by Federal Councillor Ueli Maurer and Joerg Gasser, State Secretary for International Financial Matters (SIF), visited Asia's financial hubs.

One of the things that made the strongest impression on them was the implementation, extensive use and continued rise of financial technology in both banking and daily consumer usage.

Domestic Growth

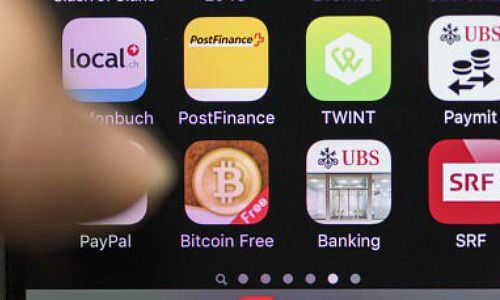

Now their home market is starting to see the spread of fintech too, something they told finews.asia they are encouraging. UBS has obliged by rolling out «UBS TWINT». The mobile payment solution, can be used to make payments at stores, vending machines and at more than 1000 online shops.

«Having set new benchmarks for P2P payment with Paymit, we’re now using TWINT to make payments at shop tills, vending machines or online a simple and convenient experience for our clients,» said Andreas Kubli, Head Multichannel Management & Digitization at UBS Switzerland.

Credit card details no longer need to be typed in when shopping online. Instead, the user simply scans a secure QR code, and the payment is made in a matter of seconds. Something that Asian consumers are already used to.

Digital Influence

UBS TWINT can be used by anyone who has a mobile phone running Android or iOS. In order to work, the mobile device needs to have a Swiss number and the user needs to select a Swiss credit or prepaid card, or a UBS account to connect to the app and use it as a means of payment.

Switzerland’s biggest bank is also introducing the digital signature meaning UBS customers won’t have to sign bank documents any longer.

UBS will allow its clients to sign legally binding documents electronically. Contracts in online banking will require the digital signature only.