Daryl Liew: «Is Asia’s Run Sustainable?»

Asian equities have delivered solid returns in the first four months of the year, largely buoyed by a pickup in the global trade cycle which has led to a turnaround in earnings expectations. What's next?

By Daryl Liew, Head of Portfolio Management at Reyl Singapore

Meanwhile, the Trump-related risks flagged in January have failed to materialise. For all his bluster during his campaign, President Donald Trump has thankfully adopted a more pragmatic approach when dealing with international issues. He has backed off from labelling China a currency manipulator and in dealing with North Korea, also reaffirmed that the U.S. will continue to be a major military presence in the region.

Trump’s failure to repeal Obamacare has also lowered expectations of his ability to implement tax reform and deliver on his huge infrastructure spending programme, thus lowering inflationary expectations. The dollar has been the main casualty in the reversal of the Trump reflation trade, and provided Asian markets with a favourable environment in which to break higher.

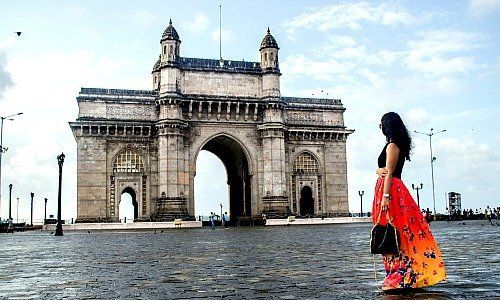

India – Secular Growth Story

We flagged India (Picture: Mumbai) as one of our preferred markets for 2017, and that call has paid off so far with India being the best performing Asian market in dollar terms (+18.8 percent). The negative effects of last November’s de-monetisation move has mostly dissipated and the strong showing by Prime Minister Modi’s BJP party in the recent state elections (BJP won over two-thirds of the seats in Uttar Pradesh, India’s most populous state) increases his re-election chances in 2019 and gives him the mandate to proceed with further structural reform.

Expectations are high that labour and land reforms will be tackled in Prime Minister Modi’s second term if the BJP can secure a majority in India’s Upper House. While the Indian market is trading at relatively high valuations, this is supported by stronger earnings growth potential amidst a favourable economic backdrop.

- We believe India is a strong secular growth candidate and remain bullish on this market.

South Korea – Defying Geopolitical Concerns

Surprisingly, South Korea (Picture: Busan) has been the second best performing Asian market, with the KOSPI up 16.4 percent – albeit with the KRW contributing almost half of the returns. This is despite all the geopolitical risks plaguing the country – the impeachment of former President Park and the related arrest of Samsung’s CEO; escalating risks of a military confrontation with North Korea; and China implementing soft sanctions against South Korea over the deployment of the U.S.-sponsored THAAD radar defence system.

Perhaps the market is pricing in an improvement in matters following the election of the new President on 9th May. Besides launching expansionary fiscal policies to spur domestic consumption, the new President is also expected to engage in diplomacy to soothe tensions with China. While valuations on the whole in Korea are undemanding, earnings growth is still rather anaemic.

- As such, we rather limit our exposure here to selected Korean companies with solid growth potential.

China – Unexpected Outperformer

In mid-March, Chinese equities were one of the top performing Asian markets, having rallied 12.5 percent at its peak. Chinese stocks have corrected since then but have posted decent returns (H-shares +9 percent), partly driven by the surprisingly strong economic numbers this year – Q1 GDP accelerated 11.8 percent y-o-y, the fastest pace in 20 quarters.

These good figures, however, have probably been driven by a build-up of inventories in the industrial sector such as steel. We do not think this growth rate is sustainable in light of tighter monetary policies implemented by the central bank which is curtailing credit growth. This, coupled with renewed property cooling measures, should result in a moderation of China’s economic growth numbers in the upcoming quarters.

Another positive has been the easing of tensions between China and the U.S. following the meeting between Presidents Trump and Xi in Mar-a-Lago in April. All eyes are now on what concessions are agreed upon to close the bilateral trade gap in the 100-day plan. While China H-shares are still the cheapest market in Asia, trading at a forward PE of just 7.6 times, the risk of anti-trade policies still remains.

- We are maintaining a neutral outlook on China.

Japan – Laggard Poised to Catch-up?

The Land of the Rising Sun has been a laggard so far this year, as the stronger yen has been a drag on the stock market. However, like other Asian economies, Japan is benefiting from the recovery in the global trade cycle – April’s manufacturing PMI rose to 52.8, the eighth consecutive month that the manufacturing sector has expanded. This has allowed Japanese companies to reduce inventories and boost producer prices, hence leading to a pickup in earnings expectations.

Meanwhile, valuations for Japanese stocks are still attractive, with the Topix trading at a forward PE of 12.9x, a significant discount to other developed markets. The improvement in sentiment for European assets and the Euro (vis-à-vis the yen) following the French Elections could be the catalyst for a recovery in Japanese equities.

- For these reasons, we are currently bullish on Japan.

Conclusion

Asian markets may come under pressure at some point later this year, possibly driven by a recovery in the dollar. However, improving global economic conditions and the stronger fundamentals of individual Asian economies suggest that the solid returns from Asia are not just a flash in the pan.