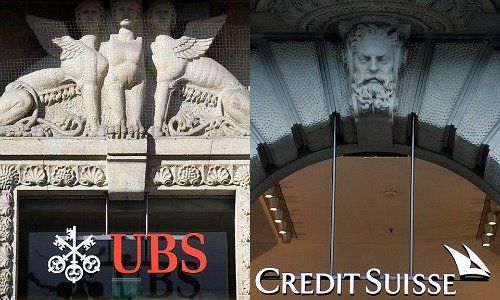

New Round in UBS vs Credit Suisse

UBS and Credit Suisse go head-to-head with quarterly results on Friday. The bank on a two-year restructuring roller-coaster is the one most likely to pull off a surprise upset - this quarter is Credit Suisse's for the taking.

Highly unusually, both Credit Suisse and UBS report results to June 30 on Friday – and much to the dismay of financial journalists and analysts, who normally have a few days in between the two European heavyweights to sort through the data.

Which bank will investors favor? Credit Suisse has far more potential to surprise investors, finews.asia predicts.

Looking Ahead

Chief Executive Tidjane Thiam is looking further forward for the first time in two years – he alluded to a 2018 to 2010 plan in a recent memo to staff, indicating that a torturous three-year restructuring plan to turn around the bank is nearing its end. While Credit Suisse's shares are poised to benefit from a very low base effect, crosstown rival UBS has been churning out regular and consistent profits quarter for quarter.

If UBS is the Nestle of banks – solid, reliable, somewhat boring and lacking spark – Credit Suisse can win back lost terrain and enliven the rivalry between the two Zurich heavyweights.

Credit Suisse's trump cards?

1. Tidjane Thiam Banishes Dougan Era

Like any CEO, Tidjane Thiam is not devoid of ego, but he has had to quash the urge to crow amid massive public and investor scrutiny of his turnaround plan.

Thus, the outsider to Swiss banking has spent two years nose to the grindstone on Credit Suisse’s most thankless jobs: shoring up capital – he has asked shareholders for 10 billion Swiss francs since taking the helm – and concluding a major mortgage scandal in the U.S.

He has done both as part of a wide-ranging restructuring, paving the way to fine-tune the bank’s strategy through 2020. Props to Thiam: by all appearances, Credit Suisse has turned the corner on the Brady Dougan era.

2. Swiss Clockwork

A rush to prepare Credit Suisse’s Swiss unit for an IPO in the second half of this year, only to be called off in May – what many including finews.asia criticized as an unnecessary exercise in futility – is revealing a hidden benefit.

The unit, led by former well-liked investment banker Thomas Gottstein, is now in fine fettle. Helped by a cost-income ratio of less than 70 percent, the tiniest of Credit Suisse’s units is also its most profitable, and its most consistent.

Two years of turmoil don’t seem to have hampered Credit Suisse’s ability to attract business from Swiss corporates, nor do turf wars over sales and trading or information technology. Bankers hired against the backdrop of the planned listing like Antoine Boublil have stayed on board. The IPO prep an exercise in futility? Hardly.

3. Surge in Wealth Management

Under Iqbal Khan, Credit Suisse's private bank has posted stand-out growth: the unit hovered up 12.5 billion francs in first-quarter net new money, and 5.3 billion in Asia.

By comparison, considerably larger UBS took in 21 billion - slower growth than its crosstown rival. Just as with Julius Baer on Monday, investors will reward a healthy showing in net new money, even if the funds aren't trickling down into profits yet.

4. Casino Culture?

Credit Suisse’s culture is suffused with investment banking as far back as its 1970s partnership with White Weld, to its 1988 purchase of First Boston and the ill-advised 2000 acquisition of DLJ at the top of the market. The Swiss bank’s securities units still make for the lion’s share of profits: 466 million francs in the first quarter, well ahead of the nearest competing unit, the Swiss bank.

Credit Suisse has also squeezed more out of its credit-heavy investment bank in recent quarters than UBS, which has to live with ignominious headlines about „missing out on a fixed income boom“ in quarters where bond-trading shines.

To be sure, Credit Suisse is sailing perilously close to the wind: its investment bank still proprietary trades, despite onerous Swiss capital rules on own-book trading. A recently set-up unit called SMG – Systematic Market-Making Group – reportedly algo-trades, which can potentially smooth results. It’s in the DNA, apparently.

Why UBS is hard to beat long-term:

1. It's a Wealth Manager, Stupid

CEO Sergio Ermotti is visibly riled: the valuation of UBS shares doesn't reflect progress made by the bank in the six years since "Accelerate," its wide-ranging fixed income cuts in favour of its flagship private bank.

"At the end of the day, what we are is not the most expensive…investment bank, we are the cheapest asset gatherer in the world," he recently lamented to in an interview with "Financial News".

If UBS sticks with its private banking strategy, the Swiss bank will close the valuation gap to pure wealth and asset managers like Julius Baer and Blackrock as well as lessen the stigma of its investment bank's prominent fall in the financial crisis. Whether it's fast enough for the impatient Ermotti, who soon enters his seventh year at the helm, remains to be seen - but UBS, as it never tires of telling clients, is in the wealth management business for the long term.

2. Size Matters - and a U.S. Presence

UBS doesn't need to worry that Credit Suisse will eclipse its private bank in size: Switzerland's largest bank is also the world's largest wealth manager, with a massive gap to its closest rival. And size matters in wealth management today: banks like UBS can make use of scale to offset expensive running costs - provided that the rush of net new money quickly translates into fees and transactions.

Here, UBS is undoubtedly in a better position than Credit Suisse because it has a major U.S. arm which has been restored to rude health. North American may not be growing as quickly as hot spot Asia, but it still represents the largest wealth market in the world, with higher volumes and, enticingly, higher margins.

Few of UBS' private banking rivals come within striking distance of the Swiss bank's sheer heft. Another plus: UBS has no need to pile into risk, and can be extremely selective with the acquisition of client money.

3. Digital Head-Start

The banking industry knows that keeping a lid on costs is long overdue, and will be decisive in the digital battle ahead. How? Ideally, with harmonized information technology that can navigate a bank's operating system from one platform.

UBS has a clear lead over rivals in unifying its booking platforms. The technology behind the move is client platform Cetus, Latin for "whale". The name is fitting: UBS is unifying its European onshore wealth management into one colossal entity in Frankfurt.

Previously, UBS maintained 12 individual booking platforms attached to its branches in Europe, running six different IT systems. Long-term, the bank's costs will fall dramatically with the unification - by as much as 100 million francs.