Hong Kong Races Past Singapore

There has been an overall drop in confidence among the world's leading financial centers. Asia, the hosts of three out of the top five centers, has seen a turnaround.

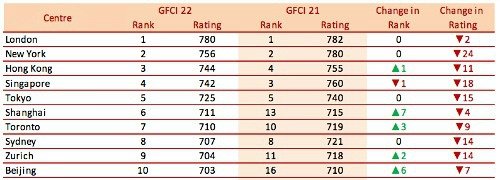

Of the top 25 global financial centers, 23 fell in the ratings and only two rose, according to the 22nd Global Financial Centres Index (GFCI 22). The report published by Z/Yen in collaboration with the China Development Institute (CDI), rates 92 financial centers and looks at future trends.

Hong Kong Moves Up

The leading financial centers in the Asia-Pacific region fell in the ratings. All the region's top ten centers dropped, with Singapore, Tokyo and Osaka all suffering marked declines. Hong Kong has moved just ahead of Singapore into third, only two points ahead on a scale of 1,000, while Tokyo remains in fifth place.

Asian Future

The gap between third place Hong Kong and second place New York is now just 12 points. This is the smallest gap between second and third places for more than five years.

New York fell by 24 points, the largest fall in the top 15 centres, presumably due to fears over U.S. trade and ongoing geopolitical concerns.

The GFCI questionnaire also asks respondents which centers they consider likely to become more significant in the next few years. The result showed six of the top nine centers in the coming years are likely to be Asian. Chinese mega-cities Shanghai, Shenzen and Chengdu rated highly.

Brexit Not an Issue – Yet

London and New York remain in first and second places. London declined by two points only, despite the Brexit negotiations – the smallest decline among the top ten centers.

Perhaps as a result of the Brexit uncertainties the British Crown dependencies of Jersey, Guernsey, and the Isle of Man all performed strongly. Malta, Reykjavik, and Gibraltar also had significant increases.