Credit Suisse boss Tidjane Thiam and hedge fund activist Rudolf Bohli are competing with opposing strategies for investor favor. Who won the first round?

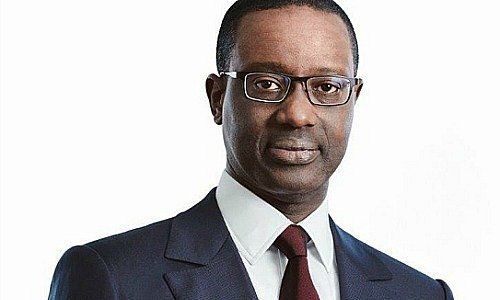

Tidjane Thiam (pictured below) has another 14 months to deliver on his three-year strategy laid out in October 2015. Since last month, he also has an activist investor, Swiss hedge fund manager Rudolf Bohli, breathing down his neck.

Bohli's vehicle, RBR Capital Advisors, wants Credit Suisse to split itself into three parts: private banking, asset management and investment banking. Why? To reap more than the sum of the Swiss bank's three, at times disparate parts command as a whole. RBR only owns 2 percent of Credit Suisse's shares, and is thus dwarfed by bigger shareholders.

To be sure, RBR has splashed itself into the headlines with a savvy media campaign. The push has drawn the attention of Credit Suisse's biggest shareholder, which has urged that some of the hedge fund's ideas be examined more closely.

Strategy Duel

Thiam and RBR are effectively locked in a battle to present the better strategy: fulfill the CEO's three-year plan for a universal bank which draws strongly on Asia and pays a juicy dividend every year, or the activist's proposal to break up Credit Suisse to release what he sees as considerable hidden value.

The timeline of the race is clearly Credit Suisse's shareholder meeting next April. To get rid of Bohli (pictured below), Thiam has to show solid evidence that his strategy is delivering without any messy complications to blur the bottom line. How did he do this quarter?

First Round: Thiam

After the first nine months of this year, Thiam can confidently claim an initial victory: Credit Suisse reported a surge in profit to 244 million Swiss francs, beating expectations. Its private banking arm hoovered up more than 10 billion francs in new client money – a key indicator for revenue in coming quarters.

- Page 1 of 2

- Next >>