MAS Warns of Deepfakes Impersonating Regulatory Officials

AI and synthetic media make it a dicey time to be a corporate employee.

The role of the corporate finance department, or for any employee on the inside with any purchasing power, is changing right under our noses.

In the old days, it might have been about payment flows, while administering receivables and ledgers. But now? Figuring out if your boss is real. Yes – the one who is now shouting at you to transfer a hefty sum while a regulator sits in the background, threatening the loss of a license for this or that.

Chilling Fashion

Indeed, the current business environment is not for the fainthearted – and we are not even talking about Trump 2.0, financial market turbulence, and tariffs yet.

An announcement published on the Monetary Authority of Singapore (MAS) website on Wednesday makes all that clear chillingly.

Executive Impersonation

It is a joint alert issued together with the Singapore Police Force and the Cyber Security Agency of Singapore, and it means what it says.

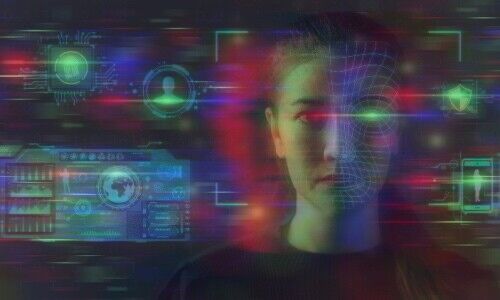

AI is being used to create or manipulate synthetic media whereby scammers impersonating high-ranking executives in companies that the victims work for are instructed to transfer funds from company accounts.

Unsolicited WhatsApps

They receive unsolicited WhatsApp messages claiming to be senior executives inviting them to join a live Zoom call.

«It is believed that digital manipulation had been used to alter the appearances of the scammers to impersonate these high-ranking executives. In some cases, the video calls would also involve scammers impersonating MAS officials and/or potential ‹investors›,» the statement said.

Too Late

The victims are instructed to transfer substantial funds to designated bank accounts under the guise of project financing or investment, with some being asked to disclose their personal information and passport details.

They eventually find out they are being scammed when the callers become uncontactable, or when they verify the executives in question, but by then it is too late.

Compelled to Act

Still, let’s look at the main takeaways from all this. It has been happening frequently enough in Singapore for the MAS and the police to feel compelled to issue an alert.

The subtext also seems to indicate that funds have been lost to scammers under the guise of this dangerous AI, synthetic media, and deepfake cocktail.

More Vigilance

At the bottom of the announcement, the MAS has recommended numerous protective measures. Most of them are aimed at asking employees to be more vigilant.

That may indeed be the most important lesson that we can take from all this.

Impossible to Get Back

As finews.asia wrote in January, protecting clients from scammers, and employees, is going to be a tough banking nut to crack – given the victims voluntarily make fraudulent payments without them necessarily knowing they are doing so.

And once the money is gone, it is almost impossible to get back. To get defrauded in our digital age means that everything happens and seemingly above board until it is way too late, when it is well past the point of no return.

Critical Thought

The only fundamental long-term solution to all this is a good dose of clear-eyed, critical thinking.

As we wrote in February, all this could rekindle the importance of having a humanities or liberal arts degree in the financial sector and business, something that Apple has generally been wise to, but not something we commonly see in finance or accounting departments.