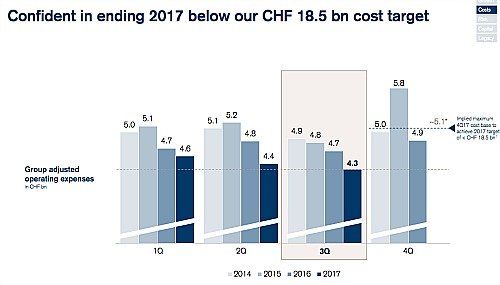

Even if profit at Credit Suisse's two investment banking units – a trading arm and an advice and capital markets arm – slipped on the year, both avoided a disaster. The bank was also optimistic that it can crunch its spending base down to 18.5 billion francs by the end of this year (it stood at 13.9 billion francs after the nine months, see slide below).

Credit Suisse also showed progress at its «bad bank,» or separately managed risks and positions, as well as in its trading department. The idea is of course to deliver profits, but also free up capital until now devoured by the risky businesses, and pour it into private banking's expansion instead.

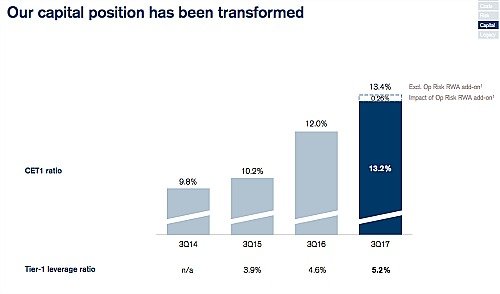

The bank's key capital ratio is now a comfortable 13.4 percent, from a sickly 12 percent last year. Its leverage ratio – a measure of borrowing versus capital – also rose to 5.2 percent, from 4.6 percent. Thiam can claim a strengthened and safer Credit Suisse, in regulatory terms (see slide below).

«The strategy works,» Thiam repeated countless times during Thursday's presentation. Stockholders seem to agree: Credit Suisse stock rose by as much as 2 percent in early trading.

Not Out of the Woods

To be sure, Thiam hasn't entirely escaped the challenge posed by the activist. He still needs to deliver a solid year-end result and ideally a booming first quarter next year – and avoid the embarrassing compensation scandal that plagued the bank earlier this year – in order to win over shareholders.

The irony of the exercise is that Thiam's «victory» will be an equal triumph for Bohli: if the bank's units post higher profits and net new money, the pull of a break-up won't diminish at all. As Thiam's plans bear fruit, RBR may be able to win backing from some opportunistic larger shareholders.

Barring the unexpected like a new scandal or major unforeseen business risk emerging, Credit Suisse's share price will rise in the coming months and weeks. Bohli is likely to claim that as a victory for his activism as finews.com has previously highlighted, but it will simply be the restructuring finally bearing fruit. Look for RBR to use that moment to exit – abandoning its break-up question in favor of a gain on the stock.

- << Back

- Page 2 of 2