The number of customer advisors working in the Asian region has risen markedly over the past year. The Swiss banking fraternity however is facing a challenging environment there, as finews.asia shows.

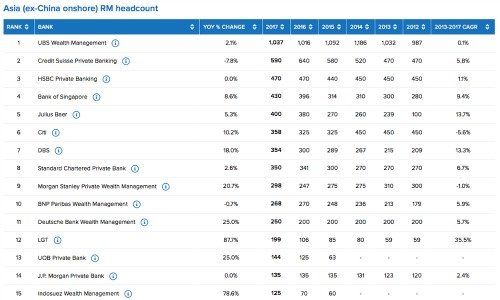

The ten largest banks operating in the Asian growth market last year increased the number of customer advisors by almost 10 percent compared with the year-earlier period. Excluding acquisitions the growth reached 4 percent, the Hong Kong financial journal «Asian Private Banker» recently reported.

The position of the Swiss market players is illuminating: While market giant UBS raised its pool by 2.1 percent to 1,037 advisors, archrival Credit Suisse only employed 590 advisors by the end of 2017, a decline of 7.8 percent (see accompanying table).

(Source: Data from Asian Private Banker)

Credit Suisse head Tidjane Thiam last November ascribed the drop to the digitalization of business processes. The long-term goal for CS is to push the number of advisors back up to around 800, he stressed.

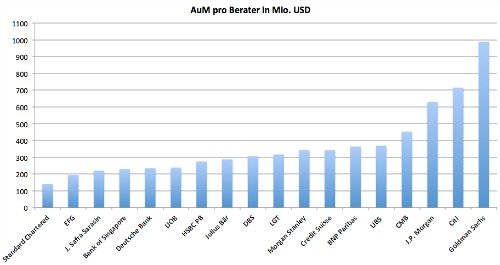

The development of advisor numbers compared with the managed assets makes for interesting reading, as this analysis by finews.asia shows.

1. Americans Lead

One customer advisor in 2017 managed on average $340 million, with the American banks leading the way. Thus a Goldman Sachs advisor was responsible for around one billion dollars (see table). At Citi and J.P. Morgan it was $715 and $630 million respectively.

(Source: Data from Asian Private Banker)

The key figure is an important indicator of the bank’s efficiency: the American banks lead the way because of the high entry point for managed assets. So Goldman Sachs will only accept clients with assets of at least $10 million.

2. EFG and J. Safra Sarasin Lag

The table also shows that Zurich-based EFG International and the Brasilian-Swiss J. Safra Sarasin operate on clearly lower assets per advisor. EFG last year also ran into problems with the takeover of the Ticino private bank Banca della Svizzeria Italiana or BSI, which was involved in the 1MDB scandal.

The result was billions of francs of client assets withdrawn. At the same time the bank was facing a trend change, previous EFG head Joachim Straehle told finews.asia in an interview last September.

- Page 1 of 2

- Next >>