Credit Suisse's investors are demanding answers in a surveillance scandal. As embarrassing personal details emerge, the Swiss bank is sitting on a time bomb.

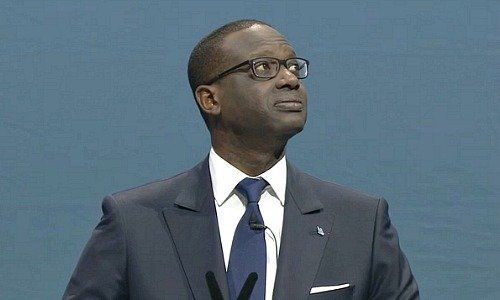

The scandal around a bungled surveillance operation of ex-Credit Suisse star banker Iqbal Khan isn't letting up. The most recent puzzle pieces to fall into place describe a dissipating relationship between Khan and Credit Suisse CEO Tidjane Thiam: the two men are neighbors, and literally fell out over some trees planted on their property line, the «Financial Times» (behind paywall) reported.

The British outlet's reporting represents the most detailed, embarrassing, and damaging revelations in an episode which has gripped Paradeplatz. It threatens to engulf UBS, the bank Khan is joining next week. UBS isn't considering postponing Khan's start date in the wake of the scandal, a source familiar with the matter told finews.asia.

Cocktail Hour Melee

Tensions between Thiam and Khan, neighbors in the swanky Zurich lakeside suburb of Herrliberg, boiled over in January. The two reportedly had to be separated by Khan's wife during a confrontation at Thiam's home during a cocktail for Credit Suisse executives, as Swiss daily «Tages-Anzeiger» first reported.

Thiam's partner, a long-standing senior financial institutions banker at Morgan Stanley, planted trees on the border of the two men's property, according to media reports. Khan objected because the trees hindered his view of the lake. In short, two Type A personalities failed to resolve a mundane domestic dispute – and the matter has mushroomed into a huge Credit Suisse scandal.

Investors Seek Answers

It fell to Chairman Urs Rohner to mediate when Khan opted to leave Credit Suisse several months after the January dispute. The lawyer-turned-overseer infuriated his CEO by granting Khan, an industry star, unusually generous exit terms, as finews.asia reported.

Rohner mandated Homburger, a white-collar law firm in Zurich, to investigate the spy scandal and report back to him directly. Meanwhile, Credit Suisse shareholders want answers: their stock has lost nearly six percent of its value this week.

UBS Heir Apparent

The longer the scandal lingers, the worse it will be for Credit Suisse – and also for Khan (and by association, UBS, where he takes up his new job on Tuesday). «It's something of extreme gravity,» a shareholder quoted by the pink paper said.

«In Zurich, it is becoming a time bomb and you can feel the panic. Both sides have been damaged, but especially Credit Suisse.» The 43-year-old Khan joins UBS as co-head of its flagship private bank and is considered a promising candidate to succeed CEO Sergio Ermotti.

Defusing Time Bomb

What happens next? The time bomb will explode if not defused. In a situation in which the only way out is radical transparency, Credit Suisse will have to apologize for an apparently management-condoned level of paranoia. It will also need to draw some consequences.

If Homburger's investigation reveals Thiam's fingerprints on the surveillance, then the 57-year-old CEO's future at Credit Suisse is in jeopardy. More likely, operating chief and Thiam loyalist Pierre-Olivier Bouée will be forced out; the Frenchman's signature is reportedly on Credit Suisse's contract with the Swiss surveillance firm.