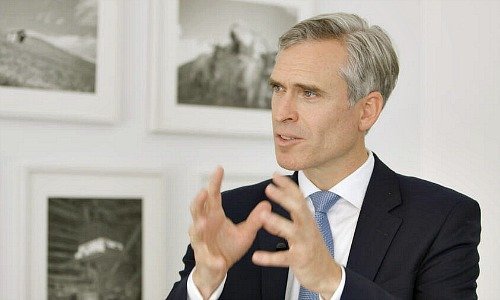

Credit Suisse Wealth Boss Emerges From Shadows

«The real challenge lies in bringing the full potential of the integrated bank – Credit Suisse – to the client,» Wehle says. The 15-year veteran of Credit Suisse's wealth arm spent two years in Singapore, in finance, where he developed incentive and bonus systems for private bankers (the Asian wealth arm is overseen by Helman Sitohang).

The Bavarian native studied economics in Bonn before joining a smaller consultancy firm run by former McKinsey employees specialized in the banking sector. Wehle said he knew when he applied for a job at Credit Suisse and admired the unique mountain scenery visible from Zurich: «I want to live here – and work here».

Military Rank

Following jobs in business development and controlling, he advanced to finance chief of Credit Suisse's wealth business in the same 2015 management overhaul which vaulted Khan, then 39, to the top of the unit. As its chief numbers man for the past four years, Wehle has a thorough understanding of the inner workings in terms of costs and credit commitments.

From a traditionally Swiss point of view, Wehle possesses the ideal attributes for a career in a major Swiss bank. Holding an officer rank in the military used to be a prerequisite for advancement in this country – and that’s exactly what he has, albeit with the German Bundeswehr, where he completed a two-year training as a lieutenant.

Russian Billionaires

Wehle recalls his time in the military as a good lesson in leadership, and also offered him the opportunity to learn Russian for ten months, as he was prepared to work on the eastern-German border in case of an emergency. Today, he only has the opportunity to use what’s left of his language skills when confronted with wealthy Russian clients, he admits.

The banker wants to place a focus on so-called strategic clients – pre-dominantly billionaires – within his division. «We want to double the growth contribution of these clients over the next few years,» he explains. He wants to better understand this type of client’s needs, with the support of Credit Suisse's asset management and investment banking arms. Babak Dastmaltschi, a long-standing banker to the ultra-rich, is overseeing a council devoted to improving collaboration within the bank for the segment.

Digital Helpers

Wehle aims to bring more systems into Credit Suisse's client advisory services and processes. Digital tools will play an important role to complement personal interaction. Wehle says he is convinced that Credit Suisse can lean on tools, for example in portfolio management, to create customized strategies by simulating potential returns.

He also has a new international unit headed by Raffael Gasser in his sights. Credit Suisse plans a pan-European hub with advisory and booking capacities in Luxembourg. The bank wants to use new technologies to support advisors and their clients in the selection and monitoring of investment decisions.

Long-Term Plans

Wehle is also hitching the unit's fortunes to one of the biggest current trends in wealth management: sustainable investments. The asset management unit he oversees plans to offer a total of 120 funds compatible with environmental, social, and governance criteria by the end of next year.

Even if he was a surprise candidate for the job, Wehle, clearly views his role at Credit Suisse as a long-term one. The father of four said he intends to become a Swiss citizen – not the first Credit Suisse top executive to do so.

- << Back

- Page 2 of 2