Polixis Outshines Compliance Giants

Regtech firm Polixis has managed to compete with incumbent compliance giants by dominating the field of know-your-client data in the oft-overlooked emerging markets.

Efficient and compliant client onboarding remains a key focus for the financial sector, especially in Asia where documentation on the roots of young entrepreneurs is not easily accessible. Be it used as a primary check or a second opinion, major compliance giants have dominated the field of know-your-client (KYC) data with scale and track record but Polixis chief executive Gagik Sargsyan noted an apparent gap outside traditional Western markets.

«For compliance data, most of the industry doesn’t pay enough attention to emerging markets and those are the markets with languages that tend to be difficult to work with, be it Russian, Chinese or Arabic,» Sargsyan explained. «Traditional vendors are concentrated in western markets that can simply use the alphabetic system but elsewhere, there are many markets with dual languages.»

Lost in Translation

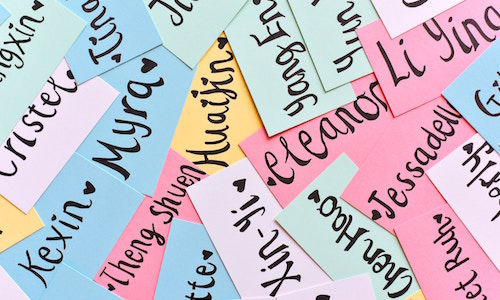

There is a myriad of unique characteristics from non-western markets regarding KYC data, such as names. A prospective client’s name could be Muhammad or Mohammad in English but spelled as just MMMD in the Arabic language – with no vowels. Or other cases, multiple persons across countries and languages could have the same name – a very common matter in various Asian countries.

«So if you are looking for 'John Smith' on your database, and there are hundreds of them, how do you know whether he is the local property tycoon or the international terrorist?”» Sargsyan asked.

Not Easily Replicable

Despite running a team with an approximate headcount of 50, Polixis has already entered the fray to compete against incumbent KYC data leaders. Several major Swiss banks have selected it as the provider of choice and are prepping to soon launch a fully automated KYC and anti-money laundering regime.

«Even an army of researchers cannot do this. We have trained our machines with our own data to create a major foundation of automation-ready data,» he said. «There are small gaps in Asia but on select markets, were are fully ready for implementation.»

More than just business acumen or tech-savviness, it may perhaps be the firm’s roots in niche linguistic pursuit that has propelled its rise.

«We love all complex and even small languages like Armenian,» Sargsyan added.