The decision to stop what would have been the world's biggest initial public offering at $37 billion came days after founder Jack Ma publicly criticized China's regulators and banks.

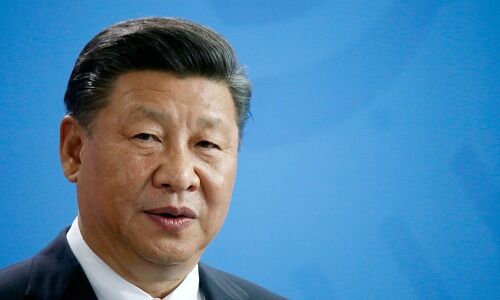

Chinese President Xi Jinping personally made the decision to pull the plug on the fintech's IPO, instructing regulators to «investigate and effectively shut down Ant's stock market flotation,» the «Wall Street Journal» reported on Thursday (behind paywall), citing Chinese officials with knowledge of the matter.

On October 24, days before Ant was to go public, Ma told a summit in Shanghai that the system was stifling innovation and was in need of reform to fuel growth. This did not go down too well with Xi, who, according to the publication, was already growing increasingly intolerant of the growing influence and capital of big private businesses, as it was seen as a challenge to the rule and stability of the Communist Party.

«What [Xi] cares about is what you do after you get rich, and whether you’re aligning your interests with the state’s interests,» said a senior Chinese official, «WSJ» reported.

Tech Selloff

In recent days, Beijing has also moved to strengthen antitrust laws and rein in the monopolistic behavior of the country’s top internet firms, amid a booming internet economy, accusing major players of unfair competitive practices.

This resulted in a sell-off of Chinese tech stocks, with losses nearing $290 billion as of Thursday.

Regulators said they plan to release new rules governing internet transactions by June 2021.