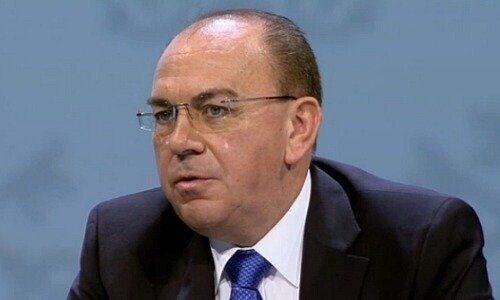

Axel Weber: «Be Prepared for the Next Surprise»

UBS chairman Axel Weber advised not only investors and companies but even politicians against relying on economic forecasts, underlining the upcoming chapter of unprecedented monetary and fiscal policy.

UBS’s Weber spoke virtually before an audience of over 5,000 attendees worldwide with regards to heightened economic uncertainty, specifically stressing that economic forecasts in the current environment are unreliable.

«Even in normal times, economic forecasts should be treated with caution, and today should be treated with even greater caution,» Weber said in his speech for the bank’s 21st Greater China Conference from the Zurich-based headquarter.

«As far as monetary and fiscal policy in advanced economies is concerned, we are in uncharted territory. I would therefore advise navigating with extra caution and not relying too much on forecasts.»

No Useful Modelling

According to Weber, the unreliability of forecasting moving forward is due to the lack of relevant data and understanding as economic and macroeconomic models have been built based on experience in the last five decades.

«But the pandemic and the monetary and fiscal policy response to the pandemic are unprecedented in the last 50 years. Neither our understanding of the economy nor our macroeconomic models are sufficient to fully understand the situation and to meaningfully forecast outcomes and assess risks,» he underlined.

«As a result of the pandemic, the environment has become very uncertain. And in an uncertain environment, politicians, firms and investors should not rely too much on forecasts, but should prepare for different outcomes and try to make their economies, their societies, their companies and their portfolios as robust as possible in order to be prepared for the next surprise.»

China: Growth Leader

Despite the worries, UBS remained optimistic about the prospects in China and expects it to be the largest contributor to global growth for many years.

The bank forecasts that economic growth in China will reach more than 8 percent in 2021 and 6 percent in 2022, underpinned by a growing middle class which will fuel a $8-9 trillion increase in the total consumption market this decade.

«China was already an attractive market in the past, but its attractiveness has increased further,» Weber said.

Developed Economies: Long-Term Suffering

In contrast, Weber expects most of the other countries to «suffer from the consequences [of the pandemic] for a long time» with expectations for economies to remain below full capacity for several years while unemployment, government debt and finance deficits to remain high.

Although UBS expects the U.S. economy to reach pre-crisis level by the second quarter this year and the Eurozone to do the same by the fourth quarter, it notes this «does not yet equate to normality».

«Normality requires reaching the pre-crisis path, which took several years after the Great Financial Crisis,» Weber explained. «Central banks will be forced to keep interest rates low and to buy a significant fraction of government deficits, thus further inflating their balance sheets. A very challenging environment!»