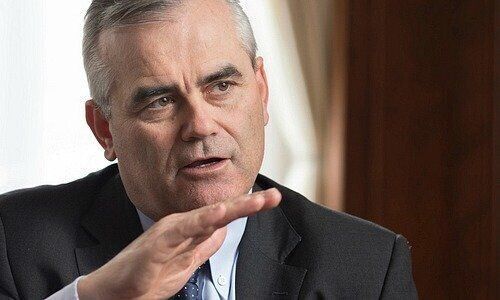

Although credit loss provisions set Credit Suisse's APAC business behind in 2020, it still posted record figures in the fourth quarter and chief executive Thomas Gottenstein has been tasked with even more ambitious growth targets for the region.

Credit Suisse has placed great ambitions for Asia where chief executive Thomas Gottenstein has been mandated with the highest targets compared to the other units – the Swiss universal bank and intentional wealth management business. This follows a 10 percent drop in APAC pre-tax income to 828 million Swiss francs ($921 million) after higher credit loss provisions offset higher net revenues.

But despite the annual profit slip, the bank could build on the momentum based on its fourth-quarter results and positive data from the bank’s latest media conference.

APAC as Growth Leader

During the conference yesterday, Gottenstein revealed the bank’s medium-term targets for the three business units with APAC leading as the fastest growth engine.

Business client volumes (defined as the sum of assets under management, custody and loans) were set for double-digit growth with a focus on lending. The net new asset growth target in the same period was set at 6-8 percent.

Not Just AUMs

The bank’s latest results posted a mere uptick of 1.3 million Swiss francs in assets under management, including a 1.1 billion Swiss franc outflow primarily driven by clients in Southeast Asia, to 221 billion Swiss francs. But Gottenstein notes that this metric alone is not indicative of the growth outlook.

«Assets under management is just one part of the story but loans and assets under custody is the other part,» he said. «This is really how i really look at the private banking franchise.»

In this latter area, Asia saw phenomenal growth – assets under custody grew $50 billion in the regional unit to $107 billion, representing 72 percent of all global growth for Credit Suisse, according to a presentation from the bank. The region now accounts for nearly 39 percent of the bank’s custody assets worldwide.

Q4 Momentum

Although regional profits dipped in 2020, the bank saw a pre-tax income boost of 18 percent in the fourth quarter to 237 million Swiss francs – outperforming analyst estimates of 161.6 million Swiss francs by 47 percent.

Client business volumes reached record levels at 354 billion Swiss francs, up 6 percent quarter-on-quarter, bolstered by higher penetration levels for discretionary mandates and funds.

China Focus

The bank has also made commitments to further expand in China with a focus on its onshore presence.

Chief financial officer David Mathers recently said the bank was looking to secure full ownership of its mainland securities joint venture as soon as possible while exploring other license applications to expand its onshore private banking interest.

Strong Start in 2021

According to Gottenstein, 2021 has already kicked off strongly with the «strongest January in more than ten years» but he adds caution to optimism.

«Clearly, one month doesn’t make a year and the Covid-19-related economic disruptions are not over,» he added. «Markets are somewhat unpredictable and we don’t know how quickly, really, vaccines are being rolled out.»

He highlighted tailwinds from «low-hanging fruits» such as improvements in the credit and asset management environment where the bank took a hit from an investment in hedge fund York Capital Management.