Credit Suisse to Liquidate Greensill Funds

Swiss bank Credit Suisse will liquidate funds holding more than $10 billion in assets managed together with imperiled U.K. supply chain specialist Greensill. It isn't clear what investors will get back.

Zurich-based Credit Suisse is unwinding four supply chain funds after co-manager Greensill began teetering. «Credit Suisse Asset Management fund boards consider that these market conditions will endure such that the funds can no longer be appropriately managed and have therefore decided to terminate the funds,» the bank said.

The move follows a week of boom-to-bust for Greensill, which is reportedly poised to apply for administration in the U.K. after the Swiss bank pulled out. It amounts to a huge debacle for Credit Suisse: it isn't clear how much it can return to investors, and it is the most severe of a series of recent asset management disasters for the bank – as well as more widely.

Warning Shot

Credit Suisse seems to have sleepwalked into the debacle despite a warning shot from GAM, a Swiss asset manager which in 2018 also suspended a flagship series of funds linked to Greensill. GAM has spent the nearly three years since then attempting a comeback. The bank reportedly sold the funds to more than 1,000 so-called qualified investors, including insurers and pension funds, as well as wealthy clients at its private bank.

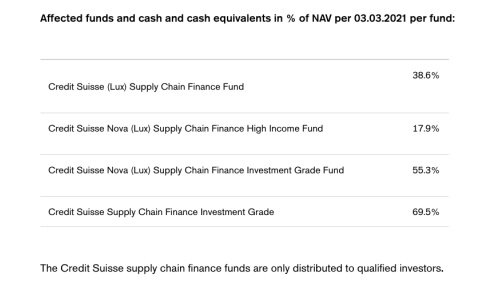

It isn't clear what the damage is: Credit Suisse said its priority is «to ensure a balance between a timely liquidation of the funds and maximizing value for the investors.» It will begin paying out roughly 80 percent of cash and cash equivalents from the four funds on Monday (three of the vehicles are Luxembourg-based, one is domiciled in Liechtenstein).

Make Investors «Whole»?

The Swiss bank left investors in the dark on whether it would «make investors whole,» or return all their money. An initial tally isn't encouraging in terms of what investors can expect from the cash portion: an investment-grade fund holds between 55 percent and 70 percent of its assets in cash, according to the bank. The other three funds' cash portion ranges from 18 percent to 39 percent.

The fund debacle has wide-ranging implications for Credit Suisse, which has long, deep ties both to Greensill Capital as well as the firm’s founder, Lex Greensill. The wealth manager granted the firm a $140 million bridge loan last year, was lined up as a book-runner on a planned initial public offering this year, and reportedly catered to Lex Greensill as a private client as well.