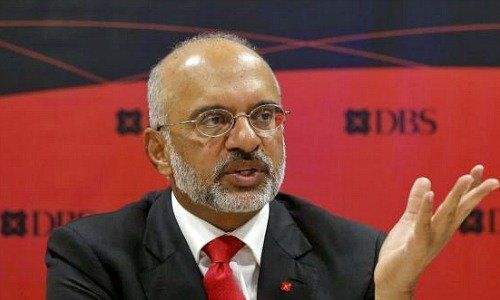

Piyush Gupta: «Tsunami of Money» Flowing to ESG Investments

Companies that focus on environmental, social and governance (ESG) tend to be high-performing companies, therefore investing in a basket of ESG stock will you cannot do too badly with a portfolio ESG stock, DBS chief executive Piyush Gupta said.

«The truth is that there is a tsunami of money being directed at ESG investments, and therefore, even if the fundamentals don't bear out, the supply-demand equation will,» Gupta said at the virtual CNBC Evolve Global Summit on Thursday.

ESG assets are expected to bring in $1 trillion in investments, Gupta noted. «If nothing else, that's going to take prices up,» he said, responding to a question of whether ESG is a passing fad or long-term strategy.

Growing Demand

DBS recently announced a revised sustainable financing target of S$50 billion ($37.53 billion) by 2024, up from its initial target of S$20 billion.

The bank said there has been renewed focus on sustainability as a result of the Covid-19 pandemic, and as more companies seek to advance their corporate sustainability agenda through sustainable financing,