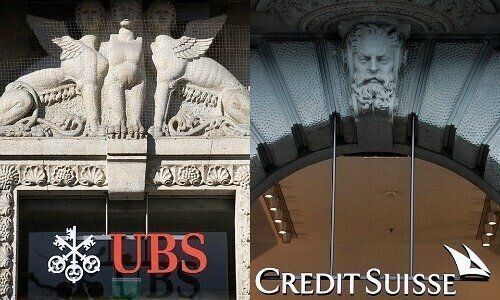

Switzerland's two major banks are usually cautious about rating each other's shares. But right now, UBS sees little potential in its rival.

Credit Suisse's shares continued to lose value and they are now trading just above 7 francs ($7.30) after it made a warning earlier this week that it would report a first-quarter loss. There is little to suggest that the stock will recover in the foreseeable future, especially after CEO Thomas Gottstein spoke of 2022 as a «transition year». Now, many bank analysts seem to be chiming in with the same view.

British investment bank Barclays lowered its price target for Credit Suisse shares from 7.50 francs to 7.00 francs on Thursday, with their banking specialist, Amit Goel, rating the stock as «underweight», which ultimately can be interpreted as a recommendation to sell.

Decisive Role in Shaping the Swiss Financial Center

UBS banking analyst Daniele Brupbacher was a little less harsh on his employers' rival, giving Credit Suisse shares a twelve-month price target of 7.40 francs and rating the stock as «neutral» earlier this week. So while not advising to sell, he is advising against buying it even at such a low price.

When the two major Swiss banks rate each other, they usually do so rather cautiously. Although they are ultimately competitors, they also play a decisive role in shaping the Swiss financial center. And no one is interested in having just one big bank in the future.

In an interview earlier this year, UBS CEO Ralph Hamers said that «it’s never a good thing when a competitor has problems,» because the reputation of all banks suffers as a result, as finews.com reported.

Not Repainting the Sistine Chapel

For decades, the business models of UBS and CS were quite similar, but have diverged over the past decade or so. UBS saw no need to repaint, merely touching up its «success model,» as former UBS Chairman Axel Weber liked to say. Credit Suisse has been laboring for years to make a new start without success, and scandal after scandal has beleaguered the bank.

This is reflected in the performance of Credit Suisse's share price and the corresponding ratings of UBS. The last time UBS banking analyst Brupbacher gave his rival shares a «buy» rating was in April of last year. At that time, the stock was trading at 9.73 francs, and UBS had formulated a price target of 10.80 francs.

One Financial Center – Two Business Models

In December 2021, UBS downgraded Credit Suisse shares to «neutral,» mainly due to the ongoing turbulence surrounding the Greensill funds and the Archegos hedge fund, but also because then Chairman António Horta-Osório had not succeeded in giving the bank a new, credible strategy. UBS's target price for Credit Suisse's shares was 9.30 francs, cut again in February to 8.50 francs and now to 7.50.

It is quite clear. From now on, there will definitely be one financial center – two business models - and the two competitors will open up a new capital in Swiss banking history. While UBS pulls away, Credit Suisse will be hard-pressed to avoid announcing personnel changes when it presents its quarterly figures next Wednesday. That is the only real way it can credibly hold out the prospect of a new start.