Gold Holds No Glitter for Ethereum Co-Founder

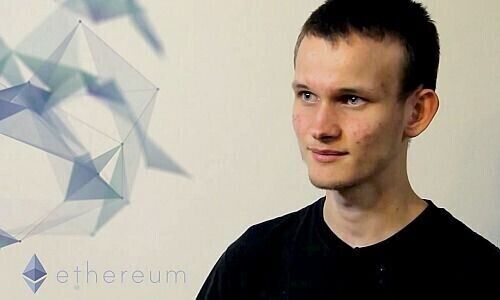

Which has more merit, digital or traditional gold? For Ethereum mastermind Vitalik Buterin, there is no doubt.

For some investors, bitcoin is the «better gold.» Others swear by the yellow precious metal and doubt that the world's oldest cryptocurrency could ever be an alternative to gold.

Fund managers like Ronnie Stoeferle from Liechtenstein-based asset manager Incrementum, on the other hand, consider Bitcoin and gold to be brothers in spirit. He does not see much competition between these two asset classes, as he explained in an interview with finews.com.

Endless Debate

The debate as to whether digital or traditional gold is the better option has been going on for years and has recently become louder. Mainly because the correlation between the yellow precious metal and bitcoin has risen sharply.

The correlation recently reached a 40-day high. In mid-August, the correlation was still at zero, as «Bloomberg» (paywall) reported a few days ago. At the same time, Bitcoin's correlation with the S&P 500 and the Nasdaq technology exchange declined.

Safe Haven?

Crypto enthusiasts see this as a sign Bitcoin is on its way to becoming a safe haven. In the wake of this year's market crash, the reputation of «Gold 2.0» as a hedge against inflation and recession had suffered badly.

Ethereum co-founder Vitalik Buterin has now joined the discussion on whether cryptocurrencies or gold are the better stores of value or medium of exchange. This question is likely to divide the opposing camps for a long time to come, but for the Ethereum superstar, the answer is already clear.

Incredibly Impractical

He replied to a Twitter user who questioned the advantages of cryptocurrencies compared to gold, saying that cryptocurrencies are the better choice compared to the yellow precious metal. Also, that gold is less common than cryptocurrencies.

Buterin says gold is very difficult to use when doing business with untrusted parties, not to mention «incredibly impractical.» In addition, the crypto icon faults gold for not supporting secure storage options like multi-sig, aka multi-signature wallets, a type of crypto wallet requiring at least two private keys to sign a transaction.

At this point, gold has lower adoption, Buterin says, leading him to conclude cryptocurrencies are the better choice.