Broadridge: JPMAM and Blackrock Tied as Top Fund Firms in China

Global asset managers are capitalizing on the opening of China’s fund industry with J.P. Morgan and Blackrock tied as the top rated players onshore, according to fintech firm Broadridge's rankings.

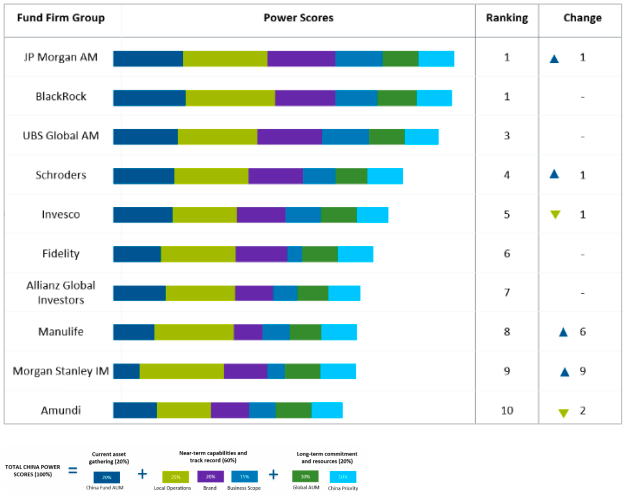

JP Morgan Asset Management rose by one position to tie Blackrock as the top rated asset manager in mainland China, according to Broadridge’s bi-annual «China Power Ranking».

The US firm boosted its ranking by capitalizing on the complete takeover of its China fund joint venture. Its domestic assets under management (AUM) in China doubled while also enhancing the firm's offering, brand and distribution network. Blackrock maintained its top position but its score fell slightly lower due to a decline in inbound Chinese AUM.

The «China Power Ranking» scores global asset managers based on six criteria with different weightings across their China fund AUM, local operations, brand, business scope, global AUM and prioritization of the Chinese market.

UBS-CS Outlook

UBS Global Asset Management maintained its position in third place, albeit with a moderate decline in its score.

According to Broadridge, the Swiss asset manager’s presence in China could be strengthened by the Credit Suisse takeover with two fund joint ventures and the potential establishment of a new fund management company (FMC).

Manulife, Morgan Stanley

Within the top 10, Manulife Investment Management and Morgan Stanley Investment Management made the biggest improvement in ranking change. Manulife rose by six positions to reach eighth place while Morgan Stanley Investment Management surged nine positions to reach ninth place.

Both firms’ scores benefited from their decision to take full control of their fund joint ventures, leading to boosts in their mutual fund, segregated account and other related businesses.

China Growth

In the previous decade, China accounted for 9 percent of net new flows but this share is projected to grow to 24 percent over the next decade, according to Broadridge, making it a key market for asset managers.

«Growth models for global managers in China differ – from an all-access model to remote operations – but the fully-owned FMC model will increasingly be the top choice for global managers serious in growing their onshore business,» said Yoon Ng, Broadridge's principal for global asset management advisory.

Overall, at least eight global asset managers in China have either established wholly foreign-owned retail FMCs or secured final approval to take full control of their Chinese mutual fund joint venture.