The search for a successor to Vontobel CEO Zeno Staub is in full swing its chairman said on Tuesday. External and internal candidates are being evaluated, but there is a preference for the latter option.

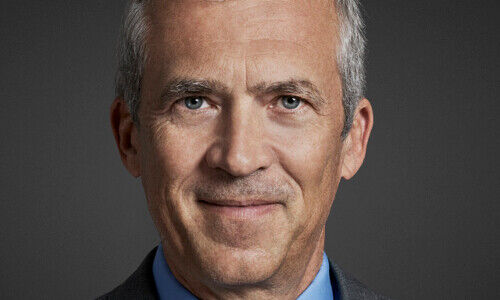

Vontobel's future CEO has to meet five criteria in particular, chairman Andreas Utermann said at a media briefing in Lausanne, with personal integrity topping the list, followed by an international cultural understanding and a strong identification with Switzerland being essential.

He conceded these parameters narrow the choice, as candidates with no real affinity with Switzerland would not be considered. Because Vontobel has a long-established Zurich-based family ownership structure, the Swiss connection is compelling, he said.

Succession by Year-End

He added that a wealth of experience in investment management was also essential, especially as Vontobel had transformed itself into an investment house around two years ago. Last but not least, criteria such as gender diversity, equality, and inclusion are important, the Vontobel Chairman stressed. With that in mind, Utermann said if there were two candidates of equal merit, a woman would be preferred.

If Vontobel favors an internal solution and a woman, the chances are good for the current head of investment Christel Rendu de Lint who is Swiss. Utermann reiterated the timetable according to which Zeno Staub's successor or successors will be determined by the end of 2023. Although Utermann easily meets the CEO criteria, he took himself out of the running. «I was elected chairman, not CEO.»

Zeno Staub and James Gorman

Utermann does not find it unusual that Staub will remain in office until the beginning of April. Long-term replacement processes were common practice in the past, especially with a successful CEO. It was only in recent years, in an era of permanent crises, the practice of quickly replacing CEOs became established. Utermann recalled on the day Staub announced his resignation, Morgan Stanley CEO James Gorman announced his while saying he would stay on for another year.

Staub's resignation was also not accompanied by a change in strategy. The current ten-year strategy was defined in 2020 under the name «Lighthouse.» An initial review around nine months ago clearly showed the company wanted to stick to this strategy, and that Vontobel is not in a transformation phase, but is merely changing its CEO, Utermann said.

I Need a Drink

Although he has not lived in Switzerland very long, the demise of Credit Suisse as an independent bank deeply affected Utermann. When the president of the Saudi National Bank, a major shareholder of Credit Suisse, declared on March 15 it wouldn't inject any more money into the bank, he was so shocked that he had several cocktails in a bar that evening, something he never does. The situation made him feel particularly bad, sensing a line had been crossed, Utermann said.

Vontobel appears to be benefiting little from the turbulence engulfing Credit Suisse, and while it has seen an influx of client money from Credit Suisse in recent months, it is not on a large scale. With its highly focused offering, Vontobel is not the right address for very wealthy Credit Suisse clients with highly complex financial needs, particularly for investment banking, Utermann explained. Nor is it pursuing an aggressive strategy to poach Credit Suisse staff.