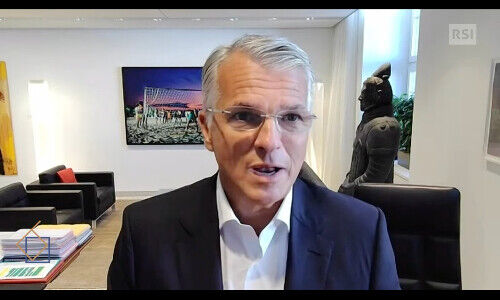

Sergio Ermotti: «The $29 Billion Profit is Not a Gift»

«The $29 billion profit is not a gift but the capital needed to integrate and support the $500 billion of CS assets on UBS's balance sheet,» commented Sergio Ermotti in a video interview with Swiss state broadcaster «RSI».

By Ugo Lagrotta, Orbit36 Risk Finance Solutions

UBS CEO Sergio Ermotti also addressed the Swiss labor market potential to reabsorb the 3,000 employees who will be affected by the layoffs and UBS's important role for the Swiss financial center and the economy at large.

Ermotti's interview with Italian-speaking Swiss broadcaster RSI during the prime-time program «60 Minutes» covered several topics (see below).

1. The social impact of the 3,000 planned layoffs in Switzerland over the coming years was the hot topic. Ermotti expressed confidence about the chances of reintegration into the labor market, citing the statistical data that 75 percent of employees laid off by UBS are able to find new employment within a 12-month period. During 2023, about 1,500 CS employees left the bank on a voluntary basis to pursue career opportunities at other institutions.

2. The financial guarantee provided by the Swiss Federal Government played a temporary role, mainly to make up for the lack of time to examine Credit Suisse's accounting data, and was intended to avoid the risk of contagion to the entire banking system when financial markets opened the following Monday.

Once the due diligence was completed, the state guarantee was no longer deemed necessary and UBS decided to remit it, deciding not to take advantage of it. «UBS's balance sheet is very strong, consisting of about 15 percent liquidity – continued Ermotti – and 20 percent Swiss mortgages and an equity of $200 billion to absorb losses (referring to Total Loss Absorbing Capital)».

3. With regards to the $29 billion profit, labeled as an accounting entry «The $29 billion is not a gift – noted Ermotti – but the capital needed to support the $500 billion of CS assets on UBS's balance sheet». On that capital, UBS will need to generate profits in line with shareholder expectations.

4. The collapse of Credit Suisse was described by Ermotti as «an idiosyncratic situation», holding accountable the CS Board of Directors and senior executives who -for years- continued to pursue an unsustainable business model.

Also not immune from responsibilities are the authorities and regulators who insisted on having two big banks at all costs, despite one of them generating losses. This is now the price to pay.

Ermotti appreciated the fact that Switzerland solved the CS problem without resorting to foreign banks or actors and that strict enforcement of the «Too Big To Fail» directive would have resulted in the bank's liquidation with a far more severe impact both from an economic and social perspective.