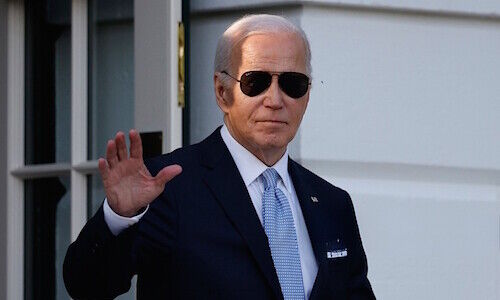

UBS: «Biden’s Withdrawal Resets the Contest»

Expect market volatility in the near term, according to UBS Global Wealth Management, as the withdrawal of Joe Biden «resets the contest».

On Sunday, Joe Biden announced that he would drop out of the 2024 presidential race, endorsing Kamala Harris as his candidate of choice. This marks yet another turn of events following the failed assassination attempt against Donald Trump on July 13.

«Biden’s withdrawal resets the contest, said UBS Global Wealth Management in a note. «However, to the extent that Harris is nominated to succeed Biden as the Democratic standard-bearer, we believe the election dynamics will not change as much as one might expect. The American electorate is highly polarized and most of Biden’s supporters will be reluctant to abandon the party’s nominee.»

Policy and Market Outlook

According to UBS, there are no expectations of major policy shifts from any top Democratic contenders that concern investors. Continued priorities include a focus on climate change, scrutiny of anti-competitive practices by large businesses, and pressure on China over its trade practices.

«In the near term, we should expect some market volatility as investors digest the news,» the bank commented. «We have seen some rotation toward ‘red' sectors and away from ‘blue' ones in recent weeks as recent momentum has favored the Republican party. That could at least partially reverse in the coming days as markets parse the latest developments.»

Investor Recommendations

In terms of strategy, UBS recommends holding a well-diversified portfolio and considering structured investments with capital preservation or yield generation features.

«Investors should remember that US political outcomes are far from the largest driver of financial market returns, or even sector performance,» the bank said, adding that its base case for the S&P 500 at end-2024 is around 5,900. «Economic data and Fed rate cut expectations remain at least as important. In addition, much can still change ahead of November's ballot and a range of outcomes remain possible.»