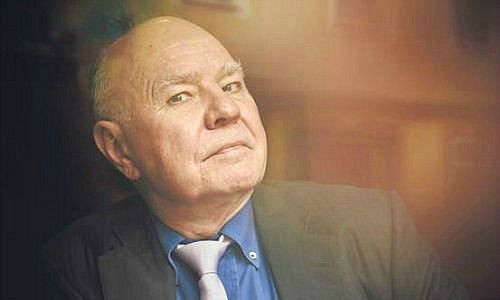

Marc Faber: «2017 – a Year of Disappointments»

The travel ban imposed by Donald Trump on citizens of seven countries will have very negative consequences for financial markets in the long term, Swiss economist and market guru Marc Faber said in a television interview. The U.S. risked losing its status as a safe haven.

«Dr. Doom», the title Marc Faber carries for his usually pessimistic views, expects U.S. assets to suffer from the travel ban imposed by Donald Trump in the «long run», according to an interview with «CNBC».

Investors with a sound common sense who previously saw the U.S. as a safe haven would ask themselves whether this would stay that way, or if Trump's protectionist policies would alter the perception of the U.S. market.

Investors to Shy Away From U.S. Markets

«I think this travel ban, psychologically, will have a very negative impact in the long run on the U.S. dollar and U.S. assets,» Faber said.

The massive trade and current account deficits of the U.S. will prevent investors to buy U.S. securities in future, not least as U.S. stocks reached records in recent days, Faber said. The benchmark Dow Jones Industrial Average rose above 20,000 on Wednesday.

Not Good for the Country

The year 2017 will turn into a «year of disappointments», because Trump's protectionism will not be good for the country. The analyst therefore expects stocks and the dollar to fall this year, against the consensus of his peers. Faber suggests investors should buy emerging markets' securities instead.