The German precious metals trader Degussa, which opened an office in Singapore about two months ago, is now expanding its offering into the digital sector.

«Starting this month, customers in Asia will be able to purchase their gold bullion or coins online via the webshop of Degussa,» said Michael Kempinski, Managing Director of the German precious metals dealer, speaking to finews.asia. After ordering, customers can pick up their purchases from the office on Orchard Road or those deposited in the company's own lockers.

German company Degussa opened in Singapore at the end of October 2015, its first branch outside Europe. They gave Singapore preference over Hong Kong, but Kempinski says, he does not rule out that the company in the medium term could open up another branch in the former British colony.

Strong Niche

Initially we are concentrating on the markets in and around Singapore, so also to customers from Malaysia and Indonesia. Kempinski also sees a strong niche for the company insofar as in Singapore, with the exception of local bank UOB no other financial institutions offer much physical gold.

Against this background he believes that the wide and proven range of gold products offered by Degussa could appeal to other local banks. «In Degussa they will find a partner, who does not compete with banks, for example, with other financial products,» adds Kempinski.

Symbolic Value for Prosperity

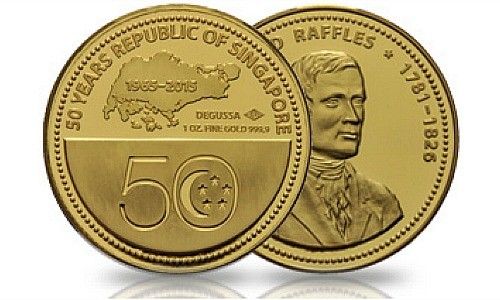

The company has always focused on precious metal products. And in contrast to the traditionally rather limited supply in Asia Degussa offers a huge variety of products and services – in addition to the classic bullion smaller unique and commemorative and special coins (for example a commemorative coin to mark the 50th anniversary of Singapore, pictured below), watches and jewelery. «And our pricing is most competitive in the market,» adds Kempinski.

He also emphasizes that in Asia the yellow precious metal possesses a symbolic value for prosperity and is also seen as a kind of insurance. «Many people in the region have experienced devaluation of their paper-money and political instability. That's why they keep a portion of their assets in physical gold,» says the native of Frankfurt, who has lived for six years in Singapore and worked most recently at UBS and Deutsche Bank.

Ongoing Monetary Pressures

Kempinski sees a sustained demand from Asia, even if the price of gold has lost value in recent years. However, given the ongoing monetary pressures in Europe, he does not rule out that gold itself – especially after the recent corrections – could once again enjoy increased popularity.