Lombard and Odier: Feuding Families

The families of Lombard and Odier are at loggerheads. Their dispute threatens to divert their attention from where it is needed most: adjusting their strategy in an industry undergoing dramatic change.

The problems have come unannounced and sneakily – and as such the bank batted them away with ease. Now they are in the open though – however much the communications managers at Lombard Odier hasten to deny that anything untoward is taking place on the shores of Lake Geneva. Listening in to what the insiders in the city of Calvin say, is revealing the depth of the problems.

B.V. and J.B. recently handed in their notice (the full names are known to finews.asia), setting the alarm bells ringing among the owners of the bank. The two are managers with stakes in the company. To make matters worse, had the two been allowed to leave, a dozen further employees would have joined them. Leading to a loss of assets under management and damage to the reputation.

Bruised Egos

The partners had no option but to promise them so much money that leaving became less lucrative than staying.

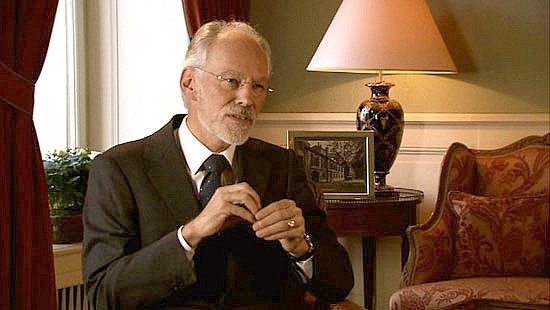

This is just one of the episodes taking place at one of Switzerland's oldest banks. The problem: there's war raging between the top two: Thierry Lombard (pictured above) and Patrick Odier.

The conflict gathered pace when Thierry Lombard left as partner at the end of 2014. He felt he wasn't awarded a departure befitting his stature.

To make matters much worse though was the refusal of the managing partners to let Alexis Lombard, the son of Thierry, take over where his father had left. Alexis Lombard had established himself as private banker at the institute. The refusal of the partners was the straw that broke the camel's back.

Upset Harmony Among Owners

One of the reasons why the controlling team of the bank didn't gel anymore is an unfortunate incident: Bernard Droux died in early 2015 doing sports. He was a down-to-earth banker with a keen sense of diplomacy that allowed him to act as a mediator among the owners.

His untimely departure created a void that wasn't filled and the gravitational forces were exacerbated by the ever increasing work load that Patrick Odier was assuming as president of the Swiss Bankers Association. Arthur Caye left the bank and Hubert Keller, the youthful head of asset management assumed more influence.

The sense of unease at the bank increased also because the traditional wealth management is not doing well. To make up for this ailing unit, Lombard Odier spent huge amounts to boost asset management – with little success so far. And that in turn increased the turnover of staff.

Old Hands Drop Tools

Olivier Collombin, the head of the business with independent wealth managers and the brain behind the online platform E-Merging, left in 2015 after 28 years at the bank, taking his entire team along. Lombard Odier also parted company with Karin Jestin, an expert in philanthropy, for unknown reasons. Which leaves a sour taste because that part of the bank's business was Thierry Lombard's responsibility.

The bank gave its best to pretend that all was well. But the fact that the holding structure of the bank was renamed to Odier from Lombard Odier didn't exactly pour oil on the choppy waters.

Thierry Lombard's decision last year to take a stake in Landolt private bank no doubt must have upset his former partners, even if the communications department at Lombard Odier hastens to deny as much.

A spokesman of the bank is keen to underline the fact that Thierry Lombard has retained an office at the Rue de la Corraterie, where the headquarters of the bank are located. But this is not necessarily a sign of die-hard friendship, because a sizable chunk of the building belongs to him and his family.

Asked for an interview by finews.ch, a personal spokesman of Lombard put this off until a later date.

Landolt – Emerging Rival in Lausanne?

Banking insiders in the French-speaking part of Switzerland are convinced that decision to take a stake in Landolt made matters much worse. The aging banker isn't merely investing some of his money in an act of goodwill. Thierry Lombard is eager to help Alexis and his cousin Frédéric Binder, who joined the Lausanne-based bank, to fulfill their plans.

Alexis Lombard over the years established excellent contacts with clients in Latin America and is trying to win over his customers from his time in Geneva. This is part of Landolt's strategy to extend is independent wealth management division.

Meeting the Challenges

Lombard Odier is facing a time of challenges. Anne-Marie de Weck, the Grande Dame of the institute, is taking her leave this year. Patrick Odier (pictured below) meanwhile will be able to devote more time to the bank, having foregone the option of extending his presidency at the bankers association. Success is far from being a foregone conclusion.

The bank will need to decide whether the asset management business is worth the investments made in recent years. Rumors had it that Lombard Odier was preparing a sale of the unit, but the bank denied that this was on the cards.

In private banking meanwhile, Lombard Odier faces the challenge of establishing new growth markets, both in Europe and Asia – which isn't an easy feat by any means. The Zurich branch is playing a crucial role in this respect, where the bank expanded in recent years under the guidance of Dominique Wohnlich, a former Credit Suisse banker.

Ending the feud between the families of Lombard and Odier would surely help the bank achieve success where it matters.